EDIT: Community member commodore64 has edited this presentation and corrected some grammatical errors I had made. Thank you!

Hey guys,

I’ve been following an interesting cryptocurrency project for some time and have noticed that very little information was available about it online, so I’ve decided to write a complete in-depth presentation of it. I do believe this project has a lot of potential investment-wise due to its great technology and vision, this is why I wanted to share it with you. This article is going to be quite lengthy, so buckle up.

What is Particl?

To sum it up briefly, Particl is a privacy-focused blockchain/P2P hybrid ecosystem that will host a decentralized and anonymous marketplace as well as an array of Dapps using a native cryptocurrency. The first officially supported Particl Dapp will be a fully decentralized and anonymous marketplace which allows buyers and vendors to securely transact between each other without the need to ever interact with a third-party. It also encompasses a fully anonymous messaging system built similarly to BitMessage. The platform is currency and protocol agnostic (more details on what this means later in the presentation).

Note, however, that these Dapps are not the same kind of Dapps as on Ethereum. They do NOT work using smart contracts but are instead hard-coded into the client. This makes Dapps much more secure and efficient.

What’s Its History?

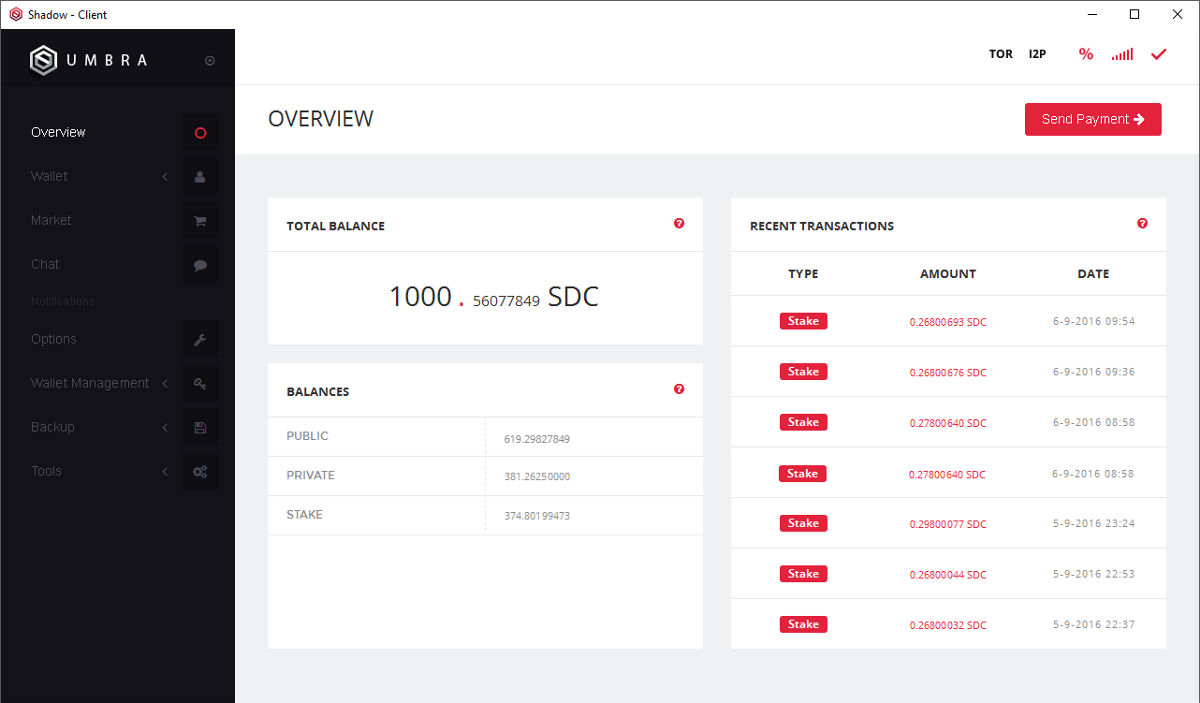

Particl is the successor of the ShadowProject (https://shadowproject.io/en), a privacy-focused cryptocurrency project started back in August 2014. The team behind this project are known for being innovators in the cryptocurrency scene, being the first to produce many feats such as an HTML5 wallet, a staking mobile wallet with encrypted messaging and transactions, as well as having the first ring signature and HD wallet implementation on BTC codebase. Their Umbra graphical wallet, built using HTML5, is widely known in the “altcoin” community for being absolutely gorgeous and very user-friendly. It was not so long after switching from proof-of-work to proof-of-stake that this very capable team started working on a fully anonymous and decentralized marketplace. This has long been seen has the ultimate value proposition of the Shadowcash blockchain.

Back in late December 2016, word spread around the community that the ShadowProject team had met with major partners in Hong Kong and that big things were coming regarding the way forward. Then, on March 17th, the team announced they were leaving the ShadowProject to start working on a new and more professional project: Particl. This move was encouraged by the fact that the team wanted to have a more professional branding and were looking for funding so that they could work full-time on it and get it going for good. In fact, they had been told by the Hong Kong partners, as well as many legal and PR firms, that the name “Shadowcash” was deemed too shady, most of them even refusing to associate their name with such a sketchy sounding project. The new vision of the project also required a lot of major code changes to be done to the SDC blockchain/client and team structure. It is for all these reasons the SDC team decided to completely sever the link between Shadowcash and Particl and start the new blockchain from scratch, using their final Umbra release as prototype for the new platform.

The Particl Foundation

The Particl Foundation is a registered Swiss legal entity. As the Particl team was looking to raise money to fund the project, they needed to have a legal body that could receive the funds and spend on behalf of the project. It is also required for most of the logistics of the project (hiring and paying employees, paying hosting fees for the website, etc.) as well as interacting with third-parties (partners, exchanges, gateways, legal & PR firm contracts, etc.). There will be many more details to come once the Foundation is officially registered. It is currently awaiting approval by the Swiss government and it is the last step to be up and running.

As a funding strategy, the Particl team offered SDC holders an opportunity to swap their SDCs for PARTs at a 1:1 rate, with the possibility for the holder to add an additional amount of BTC to the swap transaction to get a variable PART bonus added to their stash. This extra BTC is what the team collected as funding as SDCs sent into swap transactions were not and will never be sold into the market.

They have raised 750,000 USD worth of Bitcoin (now worth around 1.4M), and reserved for themselves 513,502 PARTs (6% of total supply) from the total supply. Another 996,000 PARTs are reserved for a second funding round once the MVP of the market is out and released. The funds they raised will be used for salaries, legal expenses for Swiss Foundation creation, initial business consultation expenses, new team members, professional PR, third-party code audits and University grants.

While it may have been tempting to raise more money, the reasoning behind this crowdfund structure is actually quite sane. The total amount raised is what the team estimated were necessary to run the project for one full year. It is true that other ICOs are raising tens and even hundreds of millions of dollars, but in many cases, the development team simply doesn’t need that much money. It could be argued that as these projects raise tons of money, they lose a certain incentive to work hard on their project as they have already cashed out on their idea. In more traditional VC environments, you would very rarely (if ever) see projects raise hundreds of millions of dollars with only ideas, vague whitepaper, and no working products. It is also likely that some of these projects will attract the attention of regulatory bodies due to questionable funding methods.

The Particl team has mimicked the VC way of initially going through a seed round before going for a larger round of funding. This crowdfund strategy is what was advised by Swiss legal firms which are used to working with blockchain projects. Also, not only does this structure allows for a fair money-raising method, it also incentivizes the Particl team to work hard on their project and deliver a working product that will impress the community. After all, they will want to raise as much money as possible in the second round, and with a maximum of 996,000 PARTs that can be offered, they have all the reasons in the world to make a good product which would bring more value to the Particl coin. When we think about it, this crowdfunds/ICO was pretty fair and exemplary from a legal standpoint.

Particl Features

Quick video presentation: https://www.youtube.com/watch?v=PRxmGh24ILU

Release date: July 17th 2017, 13:00 UTC

Currency name: Particl (not to be confused with Particle)

Currency ticker: PART (not PRT, which is Particle’s ticker)

Supported by: Particl Foundation (Swiss Foundation)

Total supply: 8,634,140 PARTs

Particl Foundation ownership: 513,502 PARTs (6%)

First funding round contributors ownership: 7,124,638 PARTs (82.5%)

Funds time-locked for 2nd funding round: 996,000 (11.5%)

Network consensus: Proof-of-stake (PoSv3)

Block time: 120 sec

Block size: ~2mb

Inflation: 5% year 1, 4% year 2, 3% year 3, 2% year 4+

Available on: Windows, OSX, Linux and ARM (Raspberry PI, BeagleBone Black, etc)

Bitcoin Codebase

Particl is a privacy platform using its own native currency, PART. It is built on top of the latest Bitcoin codebase (0.14.2) on which the dev team added as much as 100,000 new lines of code (as of the time of this publication) to turn it into a completely unique coin filled with a ton of cool features. Bitcoin is the first cryptocurrency to ever exist, it is the coin that everyone knows how to work with and also the most battle tested blockchain. For these reasons, it could easily be argued that Bitcoin has the safest codebase on which to build on top of.

Some other features inherited from the current Bitcoin codebase version include (but is not limited to) HD wallets, multi-sig addresses (fully integrated into graphical wallet), block pruning (saves quite a lot of disk space after the chain is fully synced), fast syncing, easy tor setup, watch-only wallet support, libsecp256k1 signing and signature validation, direct headers announcement, notifications through ZMQ, compact block support and ARM builds. You can read this article to get more information on these features: https://bitcoinmagazine.com/articles/bitcoin-core-0140-released-whats-new/

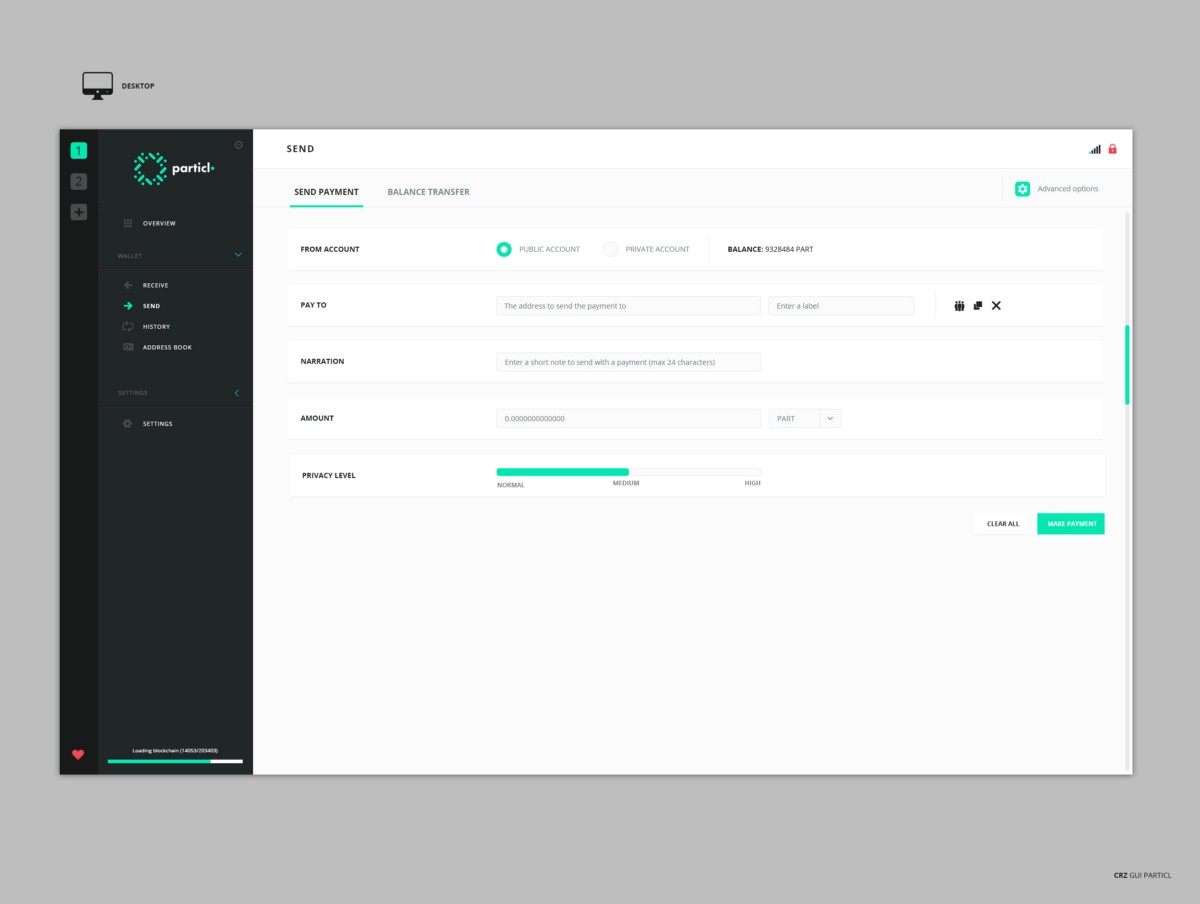

Dual Token System

Why should we have to choose between privacy and convenience when we can have both on the same chain? This is the premise behind one of the major changes the team has made to the Bitcoin codebase: a dual token system. Particl uses two different tokens that can seamlessly be transferred for one another. One of these is a public token, which carries the same pseudo-anonymity characteristics as Bitcoin, while the second one is a completely anonymous and private coin. Users can easily send public coins into private balances, and the wallet automatically converts the public coin into a private coin. The same can be done if a user sends a private coin into a public address. Sending a private token to a private address successfully “mixes” your coins and allows you to maintain top-of-the-line privacy. Note that it will be very easy and effortless to do these conversions within the GUI wallet.

Public Token

While Particl is mainly a privacy-focused project, the use of a public token (default token) is very important in terms of management, integration, and security.

One of the problems with exclusively anonymous currencies is that it can be hard to confirm the authenticity of the block creation process. What if an attacker had the key to generate an infinite amount of coins? What if no one noticed the hack until the attacker dumps large orders of fraudulently created coins on the trading market? These are very serious threats that are a reality with some of the 100% private coins. ZK SNARKS, for example, a crypto privacy protocol, also has this “hidden inflation problem”. In fact, the chain is initially generated from a set of master keys which could theoretically be used to generate an infinite amount of coins at any time without anyone ever noticing. This is why people say this protocol relies on “trusted setups”; you actually need to trust the party who spawned the chain would successfully destroy the master keys. There is, of course, no way to know for sure whether they didn’t keep copies somewhere or that they were not compromised during any step of the process (software, hardware, network, OS, BIOS, ME chip exploits). After all, cryptocurrencies are now worth a lot and they have become the primary target for hackers around the world.

It is precisely for these reasons that the Particl team opted for a fully transparent coin generation process. Because all newly generated coins are public, a hacker/bug would instantly be detected and measures could be taken to fix the problem.

Additionally, since the public token is built in a very similar way as Bitcoin, it is much easier for third-parties such as exchanges, websites, and wallets (Jaxx, Exodus, Ledger Wallet, etc.) to integrate. They do not need to go out of their way and spend many dev hours without knowing if it will be economically worth it to integrate that coin. The best example I could find concerning this, in particular, is the case of Monero and Jaxx. Jaxx is a well-known multi-cryptocurrency wallet and they tried to integrate Monero earlier this year. After trying to add the coin to their wallet, they announced they would finally not do it because it was too complicated and they didn’t feel the amount of dev time required for this project would be worth it. This would not happen with Particl as the BTC codebase is what everybody is used to working with and can integrate it without much effort.

This public token is also very useful for people who do not necessarily require a permanently anonymous experience. Fully-anonymous currencies can sometimes hinder one’s ability to effectively keep track of financial records and transactions. Some services ask for extra information (i.e. a payment ID for Monero) in order for a transaction to be accepted and there are many situations where one could forget to note that transaction ID down or lose it afterward. There’s also a lot of scenarios where one would need to go back several months into the past to see specific transaction details. In most cases, it is simply harder to keep track of things with fully private coins so having one that does possess great accountability tools is definitively a plus.

On top of this, a transaction using any privacy coin is generally going to cost more in fees than a public transaction on a non-bloated BTC codebase currency as it typically involves more data movement and computation. A “public user”, one that does not necessarily want to be anonymous, should not have to pay for privacy features he does not need. By making the public token the default coin, this ensures that only users seeking privacy options will use the privacy token, while the public users (which will probably end up being the majority of Particl users if the platform becomes mainstream) default to the public token. This also has the non-negligible effect of putting less stress on the network (as public transactions are more lightweight and do not fill blocks as much as private ones), keeping the network efficient.

Private Token

Particl’s private token has a variable degree of privacy which can be adjusted by users according to their preferences. In fact, when making a private transaction, it is possible to send it using Confidential Transactions or RingCT (which is a blend of ring signatures and Confidential Transactions). It is noteworthy to mention that this is the first time both these protocols are being implemented on the Bitcoin codebase. While a few coins use Confidential Transactions as their privacy protocol, only one uses an implementation of RingCT on their main net: Monero.

Confidential Transactions, or CT, is a privacy protocol initially developed for Bitcoin that hides amounts sent from the public and makes it visible only to parties involved in the actual transaction. While it is very efficient to obfuscate most regular person-to-person transactions, its most interesting use case is when used in Particl’s marketplace decentralized escrow system. As a matter of fact, if the market’s escrow system worked using the public token, it would be trivial for determined attackers to detect patterns in the public escrow contracts and match them to potential users. On a long enough timeline, users could be identified with particular marketplace orders with a high degree of certainty. With the help of Confidential Transactions, this cuts off this attack vector and makes the escrow system fully anonymous. To learn more about CT, please consult this link: https://people.xiph.org/~greg/confidential_values.txt

RingCT, on the other side, is an even better privacy protocol combining ring signatures to the aforementioned confidential transaction protocol. Applied on double stealth addresses, not only transaction amounts are hidden but the sender and receiver addresses as well, making RingCT transactions completely untraceable. It should be taken into consideration that RingCT will not be available when Particl first launches, but will it be implemented soon enough. This feature is currently on testnet #3, but it still requires some work before it is incorporated into the main chain. The team also wants to have it fully audited by a third-party before going live with it.

One useful feature of the Particl wallet is that users are actually presented with the option to choose the privacy protocol they want to use according to their needs. CT is a good privacy protocol for basic privacy, but RingCT is even better as it makes transactions unlinkable. However, the latter is much more expensive in fees than the first one, and people who do not require a “paranoid” level of privacy may not want to pay larger fees.

In my subjective opinion, Particl will offer the best privacy experience on the market as it is very flexible but makes no compromise. RingCT is considered top-of-the-line technology and it simply works fantastically in preserving one’s privacy. Some could argue that ZK-SNARKS offers a better solution, and that is rightfully debatable. They do offer an interesting privacy solution, but they do have their share of problems and vulnerabilities as mentioned above. Centralized coin mixers are obviously not to be trusted as there is no way to know the legitimacy of the website owner, and coinjoin services are demonstrably weak and exploitable by determined adversaries.

The hidden inflation problem is also one of the reasons why I believe Particl, with its dual token system, has a “safer” (and easier to integrate) implementation of RingCT than Monero. Don’t get me wrong, there are good arguments people could make about Monero having the better integration. For example, RingCT being mandatory and by default on all transactions makes it impossible to make a basic human mistake (they do happen), but it also makes Monero a more expensive currency to use and a blockchain less likely to be able to support a huge influx of users (as transactions are heavy and would bloat the blockchain faster). This is the kind of debate where both sides have pros and cons, so I will let you make your own conclusion on this topic.

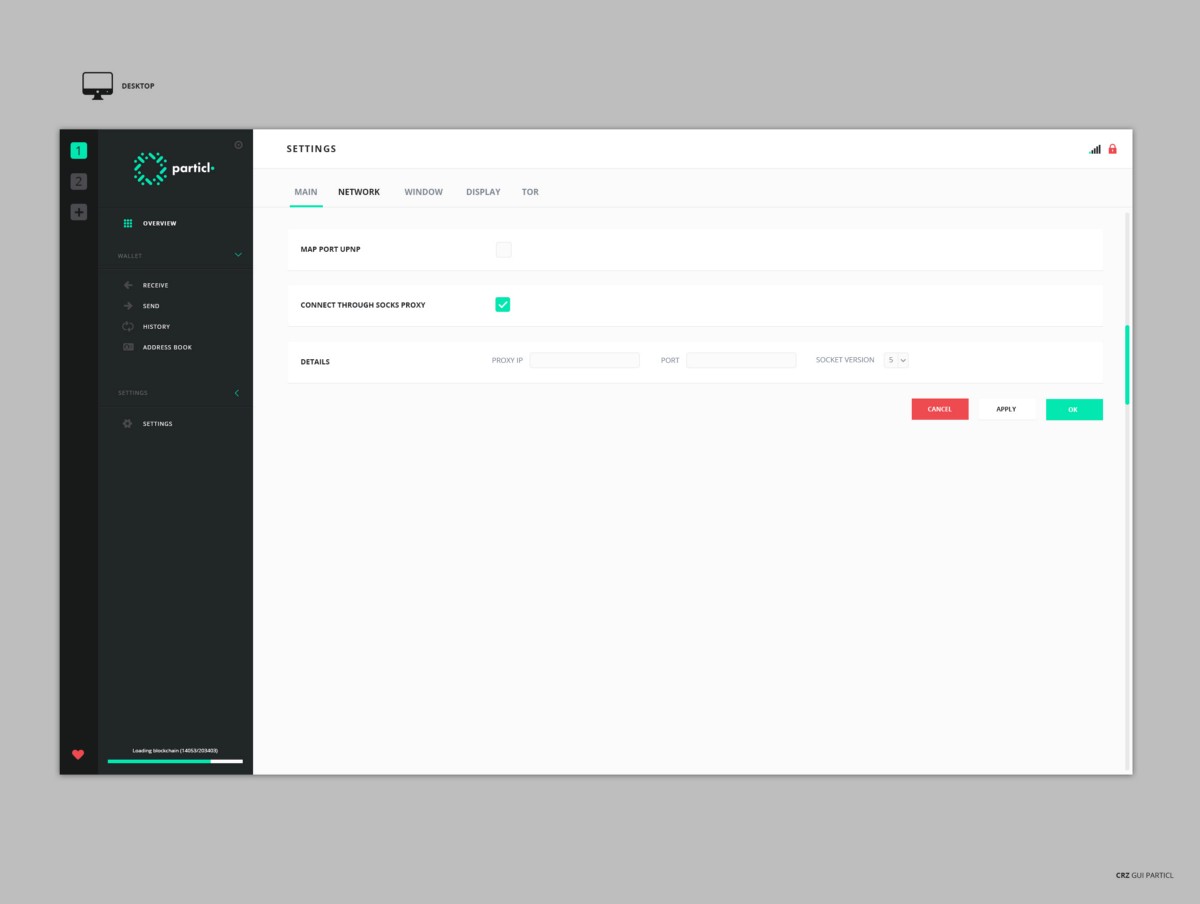

Also related to Particl’s privacy but not its private coin, it is possible to route the wallet’s connection through TOR in order to keep your node IP address private. This is absolutely needed if you want a secure staking setup (unless you used OpenVPN with solid network rules) as broadcasting the real IP address of a staking node to the world is asking for trouble.

Decentralized & Anonymous Person-to-person Marketplace

Quoted from Particl’s whitepaper draft: “Satoshi Nakamoto, the visionary and creator of Bitcoin, originally intended that Bitcoin is paired with a marketplace, as evidenced by beginnings of a market framework included in early snapshots of the Bitcoin codebase. The market-related code was eventually stripped out, however, presumably as he decided to focus first on creating his world-changing currency. The concept of a decentralized marketplace in itself is not novel, there have been a small set of academic constructions and even serious attempts at creating them. They either propose solutions that scale extremely well and neglect the privacy implications, or they propose very privacy conscious solutions that do not scale well. Privacy and efficiency are often at odds with each other,” to hide the signal there must be noise”. Tor exemplifies this well, the traffic is pushed through various nodes with several layers of encryption before arriving at its destination, it is deliberately inefficient but the privacy provided by the

trade-off is well worth it”.

In development for about two years, the Particl marketplace strives to be the first decentralized marketplace to successfully nail scalability and full privacy at the same time. The team aspires to achieve this accomplishment by using the OMP market protocol they developed internally.

Open Market Protocol

The Open Market Protocol, or OMP, is a “standardized and open format that can encompass all the economic interactions of an online marketplace” (https://kewde.gitbooks.io/protocol/content/#). The OMP is built with three main components in mind, namely extensibility, privacy, and market data portability. It can be adopted by anyone who wishes to build a decentralized market of some sort.

Its extensibility characteristic makes it much more resilient to new, more efficient technologies to come out. This aspect is explained in details in the Protocol-agnosticism section of this presentation.

Privacy is also an important cornerstone of this protocol. “Recent revelations and academic papers have proven beyond a doubt that there are many active threats to our digital privacy and security. Additionally, decentralized networks, as well as blockchains, are open public books full of sensitive information for passive attackers to abuse. This was of great concern when designing [the OMP] protocol as it could potentially put [its] users at risk”

Portability is the ability to easily move market data such as inventory, images and shipping details (among others) data between different markets. “One of the many frustrations that online merchants and vendors suffer is the lack of portability of the inventory data between the many different online marketplaces. The more markets your products are available on, the greater their exposure and thus the greater their potential revenue streams. Yet importing the inventory data into another application or website remains a cumbersome process, often on purpose to prevent vendors from using competition” By making market data standardized, it becomes very easy for vendors to open a shop on any marketplace using the OMP protocol and realize their full economic potential.

Decentralized & Trust-less Escrow System

There are many challenges in designing a fully anonymous and decentralized marketplace. One of these is to ensure that neither the vendors nor the buyers get scammed by the other party. How do you make sure the vendor doesn’t simply take the money and not ship the product? How do you make sure the buyer actually pays for a shipped product? In most cases, typical marketplaces such as Alibaba, eBay or Amazon use what is called an escrow system. The platform acts as a middle-man and receives the payment of a product or service on behalf of the vendor and holds on to it until the buyer confirms he has received the product. Should problems arise, the escrow agent will usually take the role of a mediator and decide what happens to the escrowed funds (it will either be a refund for the buyer or a release of funds to the vendor).

Since the Particl marketplace aims to be entirely trustless, it cannot use escrow agents as that constitutes centralization. An agent could be wrong on a decision, go rogue, collude with a party, and above all, they always charge a fee. No escrow agent will work for free.

The Particl team developed what they call the MAD escrow system. This trust-less and free service is based on the Mutually Assisted Destruction game theory. As defined on Wikipedia, Mutual assured destruction (or mutual assisted destruction) “is a doctrine of military strategy and national security policy in which a full-scale use of nuclear weapons by two or more opposing sides would cause the complete annihilation of both the attacker and the defender. It is based on the theory of deterrence, which holds that the threat of using strong weapons against the enemy prevents the enemy’s use of those same weapons. The strategy is a form of Nash equilibrium in which, once armed, neither side has any incentive to initiate a conflict or to disarm”.

In the context of an escrow system, it simply means that the escrow is designed in such a way that it financially punishes both parties if one of them behaves badly. The MAD escrow works by requiring the buyer to deposit twice the amount of the desired product in a 2-of-2 multisig escrow address, while the vendor has to deposit the full value of the item he is selling as insurance. Both parties need to sign the release of the funds before a set time for the deal to conclude, otherwise, the escrow busts and funds are sent over to the stakers.

For example, if you were selling a 500$ TV to a user, you would have to fund the MAD escrow with 500$ and your buyer would need to fund it with 1,000$ (500$ item value + 100% insurance deposit of 500$). The document section of the shadowproject.io website explains in an understandable fashion how the psychology behind MAD escrow works:

From ShadowProject’s documentation page: “If the buyer receives the item and decides not to finalize the transaction then the address becomes unspendable after the expiration date and neither party gets their insurance deposit back. The buyer will have effectively paid twice the price but the vendor loses his insurance deposit and the item. [If] the vendor does not to ship the item, [it] leaves the buyer with the option to finalize the transaction or not: finalizing the transaction causes him to minimalize his losses to one time the price of the item and the vendor makes a profit of one time the item price. If the buyer decides not to finalize the transaction he loses twice the amount of the item price but also causes the vendor to lose his insurance deposit. The buyer is to some extent at a disadvantage and motivated to finalize the transaction to minimize his losses in case of a vendor scam. Both the buyer and the vendor will be motivated to extend the escrow transaction and work towards a refund agreement that both parties are willing to sign.”

Of course, this MAD escrow system is flexible. If a problem arises during a transaction, both parties can agree to either extend the escrow deadline time or proceed with partial refunds. It is also entirely up to the users to decide what insurance deposit percentage they want to use. A vendor and a buyer could agree for a 25% insurance deposit, meaning that for a 500$ TV purchase, a vendor would need to deposit 125$ into the escrow while the buyer would need to deposit 625$ (500$ + 25% insurance deposit of 125$).

Self-Governance

Another of the big challenges in designing a decentralized and anonymous market is trying to reduce the irresponsible and criminal use of the platform as much as possible. Since it is censorship-resistant, no central authority can delete its content and so it could easily be abused by criminals, spammers, and trolls. This would end up making the platform look much less appealing to the regular honest user and enable undesirable activities.

Particl’s solution to this problem is a self-governance system where users can flag undesirable content. At this moment, it is not confirmed whether a listing considered undesirable is completely taken out of the market or if it puts it in an NSFW kind of state where users can decide whether they want that type of content to be displayed or not (similar to how OpenBazaar does it). The method of governance is also not confirmed, but if we are to speculate, it could possibly be tied to staking like Particl’s voting system works (will be explained later in this document).

Private Listings

As mentioned just above, there is a self-governance in place preventing the platform from essentially becoming a decentralized version of the infamous Silkroad marketplace. There is, however, a form of listing which cannot be flagged by the community: private listings. These listings do not appear on the public marketplace and are hidden even from the blockchain itself as they are fully encrypted. Only a vendor and a user possessing a specific link to the listing can have access to its content, making it a very interesting use-case for alternative markets as anyone could simply run a website making external references to these private listings, fundamentally creating the perfect semblance of a 100% anonymous and censorship-proof (even from Particl’s self-governance system) marketplace that cannot get hacked, be busted or exit scam their users.

Fighting Spam

As mentioned above, spammers are another major concern on popular blockchain platforms. In the crypto world, there are many reasons why one would want to mount a spam attack on a chain. It could be because that entity wants to short the coin on trading markets, or because he has invested in a competing platform that is seeking to destroy the reputation of Particl.

Fighting spam attacks will always remain an ongoing battle as spammers will always try to find new ways to make themselves an annoyance, and the Particl team plans on keeping the platform spam-free a priority. On market release, the platform will already be armed with two spam-fighting features other than the self-governance flagging system.

The first one of these measures is to make listings stay up for a maximum of 48 hours. That means a spammer has to constantly keep the attack up otherwise it will not have any long-term damage to the platform. This also helps the market be much more scalable as it only requires to have two days worth of listings. The second measure is the implementation of a very small listing fee (initially 0.01 PART, can be adjusted and ultimately made dynamic) making a sustained attack quite costly for an attacker. While the fees are quite small, mounting a considerably effective spam attack would require large amounts of funds to be paid to the market every two days.

As will be explained further down this presentation, market fees actually go to the stakers (people who run nodes that secure the network), which brings an interesting dynamic…Any spammer that wants to heavily spam the Particl marketplace inevitably ends up sending his money to the very community he is trying to bring down!

Going Mainstream

The project doesn’t hide the fact that it wishes to become the first decentralized marketplace to become used in the multi-billion “mainstream” world of commerce. This is why user-friendliness and usability are at the core of the team’s strategy. The ultimate goal is to make the cryptocurrency side of things all in the background so that even your grandmother could intuitively use it.

Another mainstream-appealing feature the team is working on is the integration of many in-client fiat gateways from which one could fund his Particl wallet. Some solutions being explored at the moment would allow users to use bank transfers, credit cards, and Localbitcoin-style services. Note, however, that neither the Particl developing team nor the Particl Foundation are licensed financial organizations, therefore this implementation most certainly would be the result of partnerships with other services (i.e. Changelly, Tether, etc.). It would be very surprising if fiat gateways were part of the initial release of the wallet.

Low Fees

One great thing about the Particl marketplace is its relatively low prices compared to centralized competitors. In fact, selling on websites such as Amazon or Alibaba is great because they bring vendors a lot of users, but they also charge a huge premium just so their user base can be leveraged. After all, it is generally Amazon/Alibaba/eBay that brings a company new customers, not the other way around, so that premium fee is the price to pay to get new customers from these big e-commerce platforms.

Let’s take Alibaba, for example. It is one of the most valued e-commerce websites on the internet and has a huge user base of both buyers, merchants, service providers and suppliers. If you wanted to start selling products on it, you would probably want to get a gold membership so you don’t get absolutely buried in the thousands of listing and so that you at least have a minimum set of features you could use. Their gold membership is subscription based and according to Harry Peterson, a professional in China sourcing and B2B (business-to-business) marketing, businesses located in mainland China need to pay almost up to $5,000 USD a year just to get their membership. Businesses outside China mainland have variable subscription fees based on which jurisdiction they are doing business from, but it is estimated that an average subscription amounts to around $2,999 USD a year (https://www.quora.com/How-much-does-it-cost-to-sell-on-Alibaba). On the Alibaba website itself, subscription fees seem to be even higher, now priced at $5,999 USD a year for the full package (http://seller.alibaba.com/memberships/index.html).

Of course, there are various packages and these fees are somewhat flexible, but that gives you an idea what a gold membership costs if you want to use Alibaba as a platform and get the whole set of features that will allow you to leverage the full capacity of what the platform has to offer. Don’t forget that on top of these memberships, Alibaba charges a whopping 5% fee on any transactions done through its escrow system, as it is centralized and requires staff to manage. All these fees, end up being costly for both buyers and sellers. Remember that Particl’s MAD (mutually assisted destruction) escrow system is absolutely free of charge as it is entirely decentralized and managed by both the buyer and the vendor.

Amazon, on the other hand, chooses a different fee schedule to make its money by applying two types of fees. The first one is a generic “per-item” selling fee. You can choose two plans: the individual plan, which charges $0.99 USD per items sold, or a professional plan, which is a subscription of $39,99 USD per month (https://services.amazon.com/selling/pricing.htm).

On top of that, it also charges what is called a “referral fee” which is a percentage of your item’s value that Amazon keeps for itself. This fee ranges from 6% to an almost insulting 25% depending on the item’s category. Some Amazon-branded items can even go up to 45%. Please visit this detailed article to know the exact fee schedule Amazon uses: http://www.cpcstrategy.com/blog/2014/06/sell-on-amazon-pricing/. There is also another type of fee which Amazon can charge, but that only applies if you want Amazon to fulfill your order (meaning you send your inventory to Amazon and they do the processing, storage, and shipping for you). These fees are all indicated in the CPC strategy article I linked just above.

What about eBay? While listing an item isn’t really that expensive, your first 50 listings of each month being free and the subsequent being $0.30 USD, the website still charges you a non-negligible 10% “final value fee” (the final value is calculated AFTER shipping fees are applied) with a maximum of $750 USD per transaction. You can visit this link which details all the listings (plus some advanced feature fees I will not go into): http://pages.ebay.com/help/sell/fees.html

Etsy? Well, it is admittedly much cheaper, but still considerably more expensive than Particl. They charge $0.20 USD per listing posted and then apply a “transaction fee” of 3.5% (which isn’t applied to shipping cost as well if you are selling either from the USA or Canada but is applied otherwise). There are also various other fees if you wish to use more advanced features such as Etsy’s “Direct Checkout”. For their fee schedule, please visit this link here: https://www.etsy.com/legal/fees/.

As it is probably obvious by now, these platforms charge their users HUGE premiums, which is kind of understandable since they are critical to the success of a good number of these vendors. Particl is going to be a much, much cheaper option for vendors, regardless if they are big or small. It will also greatly benefit buyers by basically charging them no fees at all except low cryptocurrency transaction fees (listing fees are paid for by vendors). Vendors will only need to pay 0.01 PART per listing renewed every two days. This fee is likely to be made dynamic so that it goes down when PART’s price goes up and vice versa.

Target Users

Going for the mainstream world of e-commerce certainly is a huge ambition. It is true that a decentralized system is likely to be less efficient than its centralized counterparts, but it does also offer services that giants like eBay, Amazon or Alibaba simply cannot provide to their customers: privacy and censorship-resistance. So who, exactly, would end up using a potentially less efficient but more private platform than well-established e-commerce Goliaths?

During the time of the initial funding round, I’ve written a lengthy article going over exactly this question. Here’s a tl;dr list of potential early users:

- Controversial & potentially illegal goods & services

- Perceived gray area businesses

- Unfairly blocked businesses

- People looking for better protection of personal/corporate data & documents

- Taxation resistance & revolts

- People from the unbanked world where banks and e-commerce websites are not present

- Much lower fees than centralized counterparts

- Any crypto user looking to shop with his favorite coin

This article only lists what I could think of at the time, but the potential of a decentralized marketplace and escrow system is huge and there are some use-cases one could not think of until someone actually comes out with it. A potential use case not featured in my previous article which became apparent to me since is the use of Particl marketplace’s escrow system for OTC exchange of unreleased ICO coin accounts (trading coins before their chain is released). This seems to be an increasingly popular practice within the crypto world, with most vendors/buyers doing these trades on Slack/Reddit.

Currency-Agnosticism

By definition, “an agnostic person is one who believes it is impossible to know anything about God or about the creation of the universe and refrains from commitment to any religious doctrine”. In our context, the platform is considered “agnostic” because its developing team does not believe its native coin should be created with a “one coin to rule them all” mentality and thus should have a platform that can work with as many cryptocurrencies as possible. As we do not know what coins will be the most used in 5 years, let alone in a month, it is safe and forward-thinking to make the platform be ready to work with them at any time.

This feature will mostly be used for the Particl marketplace Dapp, as it will allow people to shop online using their favorite cryptocurrency without ever leaving the wallet or having to manually trade their coins prior to purchasing a product. While it may seem like that would reduce Particl’s potential valuation as that would generate less demand for its native coin, it actually does not. Because the market’s decentralized escrow is a 2 of 2 multi-sig CT PART address, it requires any non-PART purchases to be traded (automatically done by the wallet) for PART to operate. Vendors do not even need to state what coins they want to accept, as they all get paid in PART. They are then free to Shapeshift back to any coin they want, again without ever leaving the wallet.

This currency-agnosticism actually brings a lot of value to the platform’s native coin. For one, any order made on the market, whether it is paid using PART, BTC, ETH or any compatible currency, ends up being a buy order for PART. This feature also brings a non-speculative use case for all compatible currencies, as the holders of those coins can now shop online with them and not simply hold them for speculative reasons. This has the potential to end up putting a lot of buy pressure on the PART coin.

Shapeshift Integration

This ability to seamlessly shop with any coin is powered by Shapeshift. That means that any coin available on their platform can be used to shop on Particl. Some of the use cases I personally find interesting is the use of the DGX token (gold-backed cryptocurrency, not yet available on Shapeshift though…) and USDt (fiat USD-backed cryptocurrency) to seamlessly shop with coins that are backed by real assets. Gold bugs will immediately understand why this is a big deal, but let’s pause for a moment and appreciate what opportunity it presents. When was the last time people could just go out and shop using actual gold coins? The way it is designed, the vendor does not even have to “accept” the currency on his store, and you can send tiny fractions of that gold coin (which is obviously impossible with physical bullion). This could become a really big use case for Particl if the world economy ends up crashing and people abandon fiat for value-based assets such as gold. This could even initiate a paradigm shift in how people conduct commerce around the world.

Note, however, that this Shapeshift integration is a temporary solution as the team plans on designing its own fully decentralized and trust-less currency exchange system. This is due for much later though, and I believe that for the time being Shapeshift will be more than satisfying as an option.

Protocol-Agnosticism

In this context, being protocol agnostic refers to the fact that the Particl platform does not limit itself to one decentralized data storage protocol, but rather makes it extensible and easy to integrate various different protocols at the same time, and let the user choose which one he prefers using. As Kewde, a Particl developer, elegantly puts it on his Open Market Protocol GitBook: “Technology moves at an exponential rate, and the very few protocols that survive the test of time are all designed with extensibility in mind. A protocol looking to be relevant on a long enough timeline should be both robust and flexible enough that it easily allows any developer to securely expand it. The development of decentralized storage networks (DHTs, BitTorrent, IPFS) and blockchain solutions is still young, there aren’t any clear “winners” that meet all criteria nor may there ever be, thus the protocol must accommodate for it”.

To illustrate why this is a good concept, let’s say Particl only uses its native SMSG protocol to run its marketplace on. That would work fine…until the marketplace gets very popular and cannot scale anymore because there are too many people using it. On a protocol-agnostic platform, it would be very easy to simply add a new, more scalable protocol to support the flock of new users, but if it wasn’t designed with extensibility in mind, it would be stuck with a technology that cannot support its own popularity. In most cases, the platform would either be abandoned by its users, require some kind of fork (which is risky), or the developing team would abandon the project and start a new one with better technology.

In other words, Particl is designed in such a way that it embraces new protocols instead of being rendered obsolete by them, and it does so without ever requiring a fork of some kind.

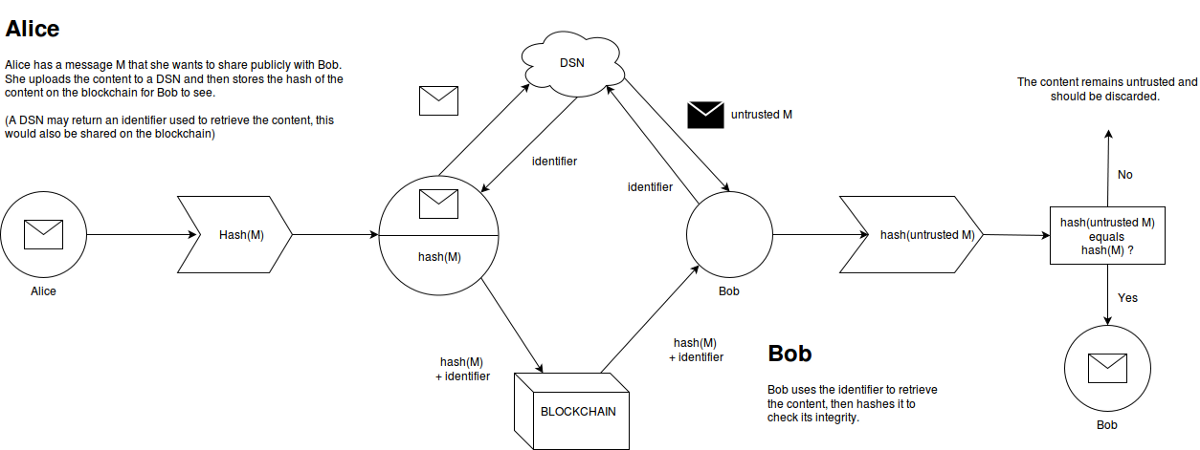

Decentralized Network Storage

Decentralized storage networks, or DSNs, are decentralized extensions “plugged” into the Particl protocol to help it store data in a decentralized and off-chain fashion. They are what I referred to as “new protocols” in the last section. The use of DSNs is essential as the Particl platform does not store its marketplace data on the blockchain itself as that would quickly bloat it and make everything much more inefficient. Here is an excerpt from Particl’s whitepaper draft:

“The Data Storage Network (DSN) is tasked with storing market listings as well as messages between sender and receiver and all other accompanying data (such as but not limited to images and videos). Sensu stricto the market listing references, stored in the blockchain, are also protocol-agnostic, simply meaning it can handle different DSN protocols such as BitMessage, IPFS, HTTPS…”

Here is a non-exhaustive list of DSNs that could be integrated into Particl:

- HTTPs (Privacy:- ( — )

- TOR (Privacy: + + )

- SMSG (Privacy: + + + )

- * IPFS (Privacy: + )

- * Siacoin (Privacy: + )

- * Storj (Privacy: + )

- * SafeNetwork (Privacy: + + + )

* This DSN hasn’t been integrated yet or is not production-ready.

As there isn’t really a “best” solution, the Particl platform lets users choose which decentralized storage network they want to use. Some DSNs provide great anonymity characteristics but don’t scale as well as others (such as is the case with SMSG). Some provide great scaling capabilities but are more expensive to use. There is also the fact that some of these DSNs required a native token transfer (Sia, Storj, SafeNetwork), making the integration trickier (but still possible) and possibly less interesting for users. Don’t forget that these DSNs which use a native token either charge the uploader of content or the downloader depending on what storage network is being used.

While DSNs are mostly used by the marketplace application (and the messaging system in the case of SMSG), the agnostic and extensible design has been standardized by the team so that it can be easily deployed whenever the platform needs to interact with third-party software, once again ensuring that it never gets outpaced by new technologies but embraces them instead. It also has the potential to add use-cases to other blockchain projects (for example, providing a complete and decentralized merchant and escrow system to Siacoin).

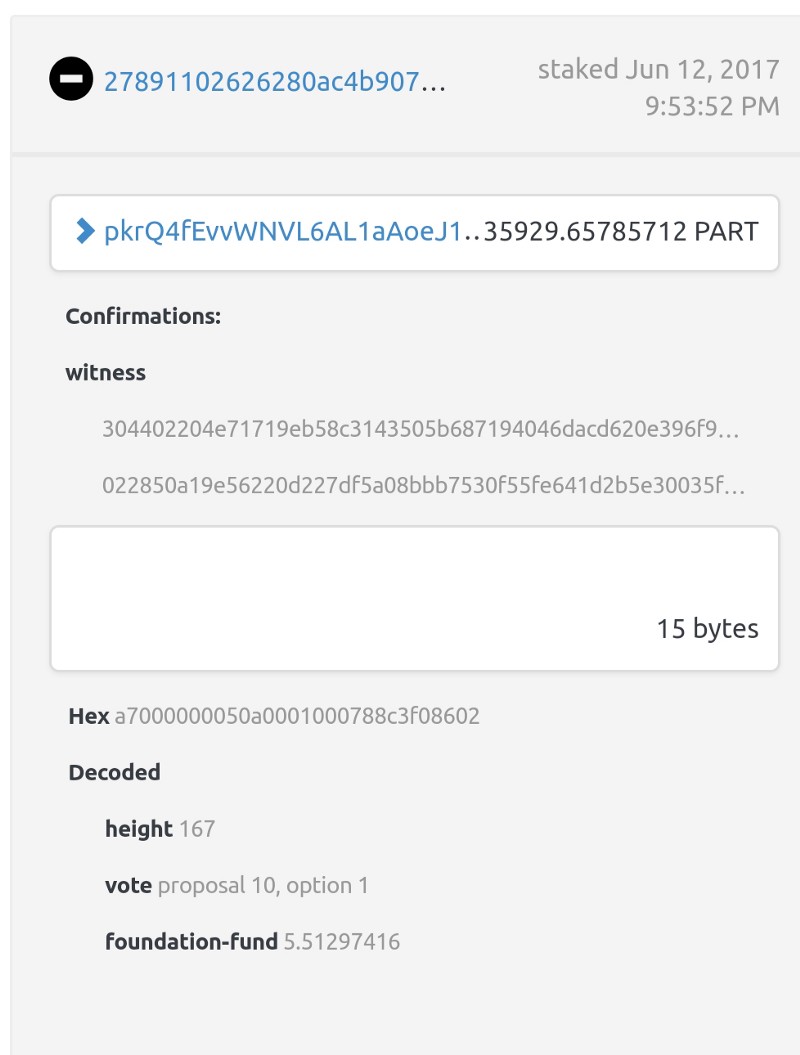

Proof-of-stake Consensus Algorithm

From Wikipedia’s proof-of-stake page, “Proof-of-stake (PoS) is a type of algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus. Unlike proof-of-work (PoW) based cryptocurrencies (such as bitcoin), where the algorithm rewards participants who solve complicated cryptographical puzzles in order to validate transactions and create new blocks (i.e. mining), in PoS-based cryptocurrencies the creator of the next block is chosen in a deterministic (pseudo-random) way, and the chance that an account is chosen depends on its wealth (i.e. the stake)”. Paid at every block, PoS basically financially rewards users for securing the network. It is also much easier to start staking than it is to start mining (as you need to buy a lot of equipment and do some research to understand how it all works), so it could be argued that PoS is a more decentralized and “people-friendly” decentralized consensus algorithm, only requiring users to buy coins, deposit them on their wallet and let it open as often as possible.

Particl uses a pretty recent version of PoS named PoSv3, and has a variable inflation rate that goes as follow:

Year 1: 5%

Year 2: 4%

Year 3: 3%

Year 4+: 2%

Staking As an Investment

Particl’s inflation calendar has been designed this way to support the price during the adoption period by making it quite profitable to stake. Once the marketplace application is more popular and as staking rewards reduce over time, the “burden” of price support should organically transfer from speculators to marketplace users.

One thing that is important to understand about staking rewards is that you are guaranteed to get a 5% interest profit in the first year if 100% of the network’s coins are staking. Staking becomes increasingly more profitable as less and less people stake. This is a direct incentive to get as many nodes staking as possible. However, it is highly unrealistic to think the entire network would be staking as evidenced by Shadowcash’s historical statistics; the percentage of SDCs staking used to oscillate between 35%-50% of the entire network. On Particl, if 50% of the network was to stake their coins, that would mean you could expect an estimated 10% yield on your first year (if you let your wallet open 24/7).

Another interesting dynamic resulting from the way PoS was implemented is that market fees are paid directly to stakers. As explained earlier, the marketplace asks for a small 0.01 PART listing fee every 48 hours to fight spam. That means that as the market gets more activity, it becomes even more profitable for stakers. If it gets popular enough, it could completely nullify the effect of the decreasing inflation rate on staking rewards and possibly even making them bigger in the end. Other fees paid to stakers include regular transaction, CT and RingCT fees. Note that as the platform gets more Dapps other than the marketplace, the fees they generate would generally be sent to stakers.

Could there even be more financial incentives to stake? Yes, there is! As explained earlier, MAD escrows have a timer that forces both participating parties to release the funds before it runs out. This timer can, of course, be extended if both parties agree to, but what if it is not and the escrow runs out of time? All the funds are added to the staking rewards, which in some cases could amount to pretty big bonus rewards!

Staking As aParticl Foundation Self-Funding Strategy

When calculating potential staking rewards, it is important to deduct 10% from the final number. Why? The Particl Foundation didn’t want to simply rely on two funding rounds as they have a very long-term vision for the project, so they had to find a way to get constant funding. A solution they found was to take 10% of daily staking rewards and use those coins to fund the project (hire devs, launch marketing/PR campaigns, etc.). If you are familiar with the DASH project, they were the first ones to adopt such a strategy and it could be argued that it is one of the reasons they are doing so well right now.

Economic Dynamics of Staking

Since it has been first implemented, proof-of-stake has been observed to propose a different set of economic dynamics than proof-of-work. The major reason why this is so is that stakers don’t actually need to sell their stakes like miners who need to pay for various expenses (electricity, maintenance, temperature management, etc.).

In fact, if one was to analyze PoS blockchains, he would notice that most staking nodes actually hoard staking rewards rather than cash them out. Since there is no expense tied to staking, it is actually much more beneficial to re-invest (stake) your new rewards as that increasingly makes it more profitable as time goes by, a concept named compounded interest.

“Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Thought to have originated in 17th-century Italy, compound interest can be thought of as “interest on interest,” and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount. The rate at which compound interest accrues depends on the frequency of compounding; the higher the number of compounding periods, the greater the compound interest. Thus, the amount of compound interest accrued on $100 compounded at 10% annually will be lower than that on $100 compounded at 5% semi-annually over the same time period.” (http://www.investopedia.com/terms/c/compoundinterest.asp)

For example, at a 5% reward rate, a staker having 1,000 PARTs would end up the year with 1,050 PARTs. On the second year, his 1,050 PARTs would increase by 4%, leaving the staker with 1092 PARTs. Another staker decides to sell his stake as he receives them, so on the first year, he would have made 50 PARTs of profits. However, because he decided to sell his stakes as he receives them, his second year of staking would only yield him 40 PARTs (1,000 * 0.04). Comparing these two stakers, the first one made a 92 PARTs profits while the second one made 90 PARTs. Note, however, that this example has been simplified for the sake of this presentation. In reality, staking rewards are paid at every block, not every year, so this “build-up” effect that causes stakers to get more PARTs rewards as they re-invest actually happens more quickly, making it even more profitable than in this example.

I’ve made a simple Calc file that allows you to easily calculate your staking rewards depending on the number of market listings, the estimated yearly return rate, and your PART balance. It takes compounded interest into consideration. Please follow this link to download and play with it: http://onlyo.co/2uQdLoM

Another interesting economic dynamic proof-of-stake provides is that it generates a coin supply shock on trading markets.

There are two main reasons for this. The first one, as explained above, is that stakers demonstrably prefer hoarding over spending their rewards, creating much less selling pressure on markets. Generally, this would make the coin’s price higher as the supply is reduced while demand stays unaffected. The second reason is directly related to the potential gains a staker can make by simply leaving his computer open. Some people would rather not risk trading their assets, so getting a solid 5–10% investment return under a year can be very appealing, making the coin more in demand. Taking both these dynamics into consideration, it could be said that proof-of-stake increases demand while reducing supply, which generally makes the coin more valuable.

One problem with that, though, is that if not enough people want to sell the currency on the markets (and simply hoard it instead), it can create a kind of liquidity crisis where not enough coins are put for sale. This is far from ideal for speculators with large sums of money who wouldn’t want to accumulate coins on an illiquid market as making a large order could dramatically increase the coin’s price. It is also not a very good marketplace currency as you want to easily be able to buy it at a relatively stable price. To understand why simply ask yourself if it makes sense to have the price increase by 10% just because you made a large PART order to buy a 10,000 USD car on its market. This is not sustainable, so what would be the best way to have a healthy and profitable balance between supply and demand?

Currency-Agnosticism & Proof-of-stake Combo

I believe Particl already has a working solution implemented to balance its staking dynamics with Shapeshift. Remember how I said the market is currency-agnostic and uses Shapeshift to seamlessly exchange other coins into PARTs? Well, it’s not just the marketplace itself, but the entire Particl platform that is so, making it very easy and tempting to actually diversify your portfolio by shape shifting your rewards into other coins. Even though it can be historically demonstrated that stakers would rather keep their rewards than selling them, a proof-of-stake consensus protocol has never been implemented on a currency-agnostic platform.

Everybody says it: diversification is the key to a profitable and healthy portfolio and staying in only one currency is actually pretty risky. What an easy Shapeshift withdrawal option provides is the ability to very easily diversify your rewards. That means you could instantly convert PART rewards into available coins, be it BTC, ETH, DGX (100% gold-backed cryptocurrency, likely to be added to Shapeshift soon) or even USDt (USD-backed cryptocurrency). The concept of being able to be rewarded in any currency of your choice is actually quite novel and powerful, so it could be reasonably expected that this function will be used a lot.

For example, I know that I will personally keep around 50% of my own staking rewards in PARTs and shapeshift the rest into whatever currency I like at a given time. I’m surely not the only one who will use the Shapeshift integration this way…This would make the balance between supply and demand more healthy and has the added benefit of making stakers’ portfolios much more secure through diversification. Just pick a couple of coins you like and increase your bags every day!

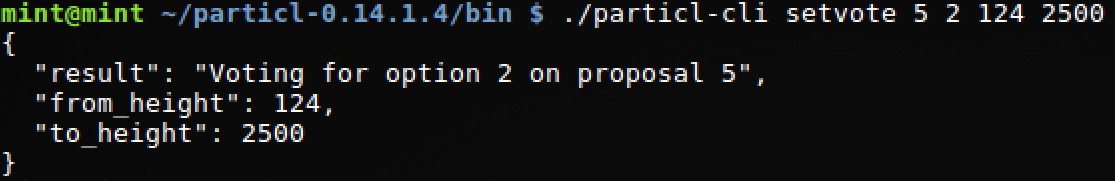

Decentralized Voting & Chain Governance

Most cryptocurrencies are designed with full immutability in mind, meaning their state (blockchain data & code) cannot be modified after it is launched (or spent, in the case of a transaction). However, recent events in crypto have shown us that a fully immutable approach to a blockchain perhaps isn’t optimal. In fact, if you are reading this presentation, chances are that you are aware of both the BTC scalability debate deadlock and the past split of the Ethereum chain (ETH & ETC) caused by a contentious hardfork.

In the first case, Bitcoin requires finding a solution to help it scale better in order to allow for more transactions per second. There are two popular solutions to fix scalability, one that requires a change to the coin’s protocol (blocksize increase) and one that doesn’t (Segwit implementation). To make things worse, their community is actually split into several groups, mainly the community (traders, holders), devs (Bitcoin Core, Bitcoin Unlimited) and miners. All these groups have their own motives and interests, and that makes coming to a middle-ground and making a decision all can agree to extremely hard. Also, because Segwit only requires miners to signal for it, it could be argued that the actual trading/holding community doesn’t have much weight in this whole debate as they can have only a very minimal impact on the signaling.

In the second case, Ethereum community was faced with a tough decision last year when their The DAO smart-contract got hacked and somebody was draining all funds from it. They had the choice to either let the attacker get away with all the funds, or make a modification to the “The DAO” contract that would have blocked the attack and refunded everyone. The second option, however, required a hardfork and it ended up being quite contentious, causing a chain split (Ethereum and Ethereum Classic). Furthermore, the polling method the Ethereum Foundation chose to use was a bit confusing. They first proposed a “Carbon Vote”, which was a method they quickly implemented to allow people to vote based on the number of coins they were holding. After much criticism, notably from the mining community, they then opted to adopt a more classic method of polling in crypto which is based on miner’s hashing rate (actually almost identical to how Bitcoin is polling its community to implement Segwit or not).

We can easily see the main issues with how both scenarios dealt with/are dealing with critical decisions. First, simply relying on miner signaling probably isn’t entirely fair to the rest of the community who doesn’t mine. It is true that anyone can use his computer to mine on whatever pool they want based on what decision the pool is taking (what is it signaling for), but not anyone has the knowledge or gear to do it, and whether this can rival the mining farm’s massive hashing rates is arguable. Also, even though the Ethereum Foundation says it also took the Carbon Vote in consideration when deciding to go for the hardfork, there were a lot of complaints from people saying they actually never heard of it. After all, only a very tiny percentage of the network went ahead and voted, so perhaps it was too complicated for most people or that the word didn’t spread fast and far enough. What makes it worse is that the voting was based on how many coins you were holding, basically making it a 1 coin = 1 vote. While that is not a bad thing in itself, it is relatively easy to game for anyone with deep pockets. An entity with a lot of money could have bought a large sum of coins, put them up for voting, and then dumped them once it’s said and done.

So with these lessons in mind, the Particl team decided to natively implement a voting system on its blockchain that can be used any time a tough decision needs to be taken by any party. Note, however, that this voting system isn’t only used to upgrade the protocol, it can be used by anybody for any reason. It could even be a vendor using the system to poll his customer base about what product they want to be added to the store, for example. They knew the system had to have a couple of key characteristics to be optimal, namely being as decentralized, cheap and limit abuse/fraud as much as possible. So how did they do it?

The Particl voting system is based on staking and is absolutely free. People wanting to vote on a particular matter need to first select their desired voting option and then make their wallet enabled for staking (which has the added benefit of further securing the network). Every time they stake a block, that will count as 1 vote. The entity who first sets up the vote parameters needs to specify to the community for how long the voting period will be open, specified in terms of block numbers (i.e. for a period of 2,500 blocks). This makes it harder to game as a large entity cannot simply buy, vote and dump instantly. They need to hold the coins for X number of blocks and actually secure the network doing so. Additionally, not only is it completely free to vote, it rewards voters with staking rewards, which definitively is an incentive to vote on stuff and not just hold the coins and go with the flow. The in-wallet integration (notably using widgets) also makes it very easy and user-friendly to participate. The only thing that requires a bit of research is that the voting content (description of the vote, pictures, graphs, etc.) will be done off-chain, most likely on Github at the beginning. Once IPFS or similar DSNs are implemented, it would then be trivial to also make the voting content in-wallet.

Decentralized & Anonymous Encrypted Messaging System

“Communication is an essential component of doing business. Modern technology gives us cheap, reliable and effortless methods to communicate with others regardless of physical distance. However, this technology does little to safeguard the content of our messages from the scrutiny of interested observers. We live in an age of constant and ubiquitous surveillance, where it becomes more difficult by the day to retain our privacy. Privacy is paramount when conducting business, the consequences of invasions of privacy can be devastating to both businesses and individuals, whether the attacker is a rival firm, a malicious individual or an overbearing government”. (https://doc.shadowproject.io/#encrypted-messaging)

Particl has its own messaging system, SMSG, used as a DSN to host listings on and “to perform communication between merchant and buyer. All nodes participating in the network store all messages of the past 48 hours, this means anyone in the network could have been the sender or receiver. The benefit of the decentralized topology is that there are no direct ties between the messages and any IP addresses. Nodes must try to decrypt all incoming messages to check if it was destined for them”.

As explained in the Particl whitepaper draft, “A message traveling on the BitMessage network does not include metadata that can reveal who the receiver or sender is. Only the encrypted payload, IV, HMAC and temporary public key are public, the receiver of a message is the only able to decrypt the message and only for them the HMAC will properly verify.” (https://github.com/particl/whitepaper/blob/master/decentralized-private-marketplace-draft-0.1.pdf)

While there is definitely some area of improvements the team is currently working on, notably concerning dual-key stealth addresses, future and forward secrecy, scalability, blockchain key distribution and RMIDs efficiency, this p2p messaging system offers a safe option for people looking to communicate and host market listings with the highest level of privacy possible.

Native Segwit Implementation

Another sweet feature of the Particl blockchain is that it has a native implementation of Segwit, which I believe is a first in crypto. One small inconvenience with blockchain projects forking their chain to add Segwit is that witness blocks aren’t compatible with blocks prior to the fork. While this is not a critical problem, it sure makes things smoother and easier to have a fully compatible Segwit implementation.

Having segregated witness on Particl gives its blockchain a couple of interesting features. Among many of these, some notable ones are the Lightning Network, transaction malleability vulnerability fixes, and block capacity/size increase.

Lightning Network is a payment channel protocol first proposed by Joseph Poon and Tadge Dryja and now scheduled for implementation on Bitcoin as well as some altcoins. LN gives interesting features to whatever coin decides to implement it such as reduced transaction fees, increased transaction speed, better privacy, and atomic swaps.

As it is becoming more and more likely as time goes by that the Lightning Network will be implemented in various different coins, its atomic swap feature is getting more relevant. Atomic swapping is the ability of an LN-enabled blockchain to be made inter-operable through multi-signature addresses and time-locks with many other LN-enabled blockchains in order to allow trust-less coin exchange between two parties (i.e. Alice can trade 100 LTC to Bob for 1 BTC in a 100% decentralized and counterparty-free fashion). This could even be used to create decentralized multi-coin payment processors or exchanges, effectively spawning a brand new and potentially breakthrough LN-focused ecosystem in which Particl could be part of. It also seems plausible that the Particl platform would eventually leverage this feature to allow trust-less currency exchange on its marketplace as well as other Dapps, effectively replacing Shapeshift with a cheaper and decentralized alternative, even though the team hasn’t made any statement on the matter.

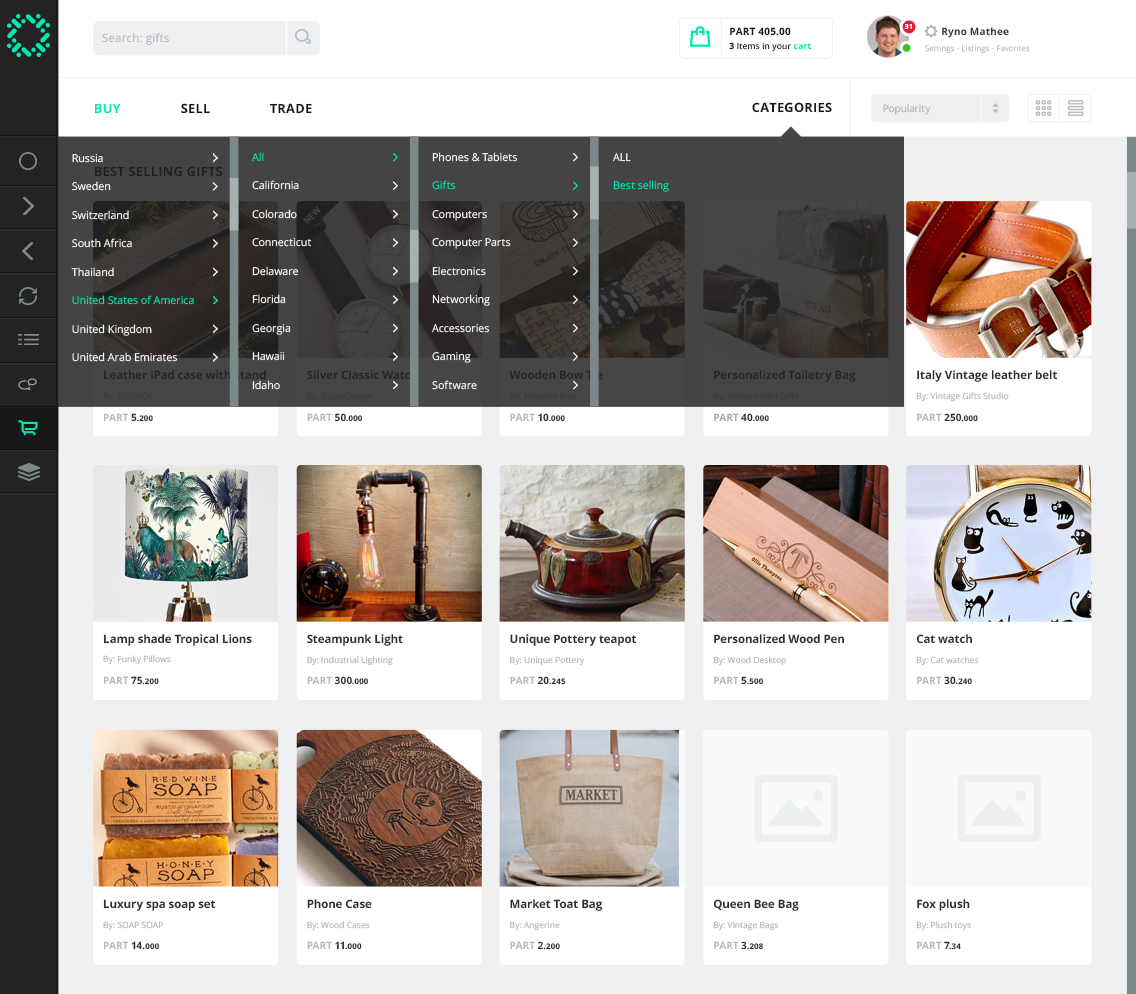

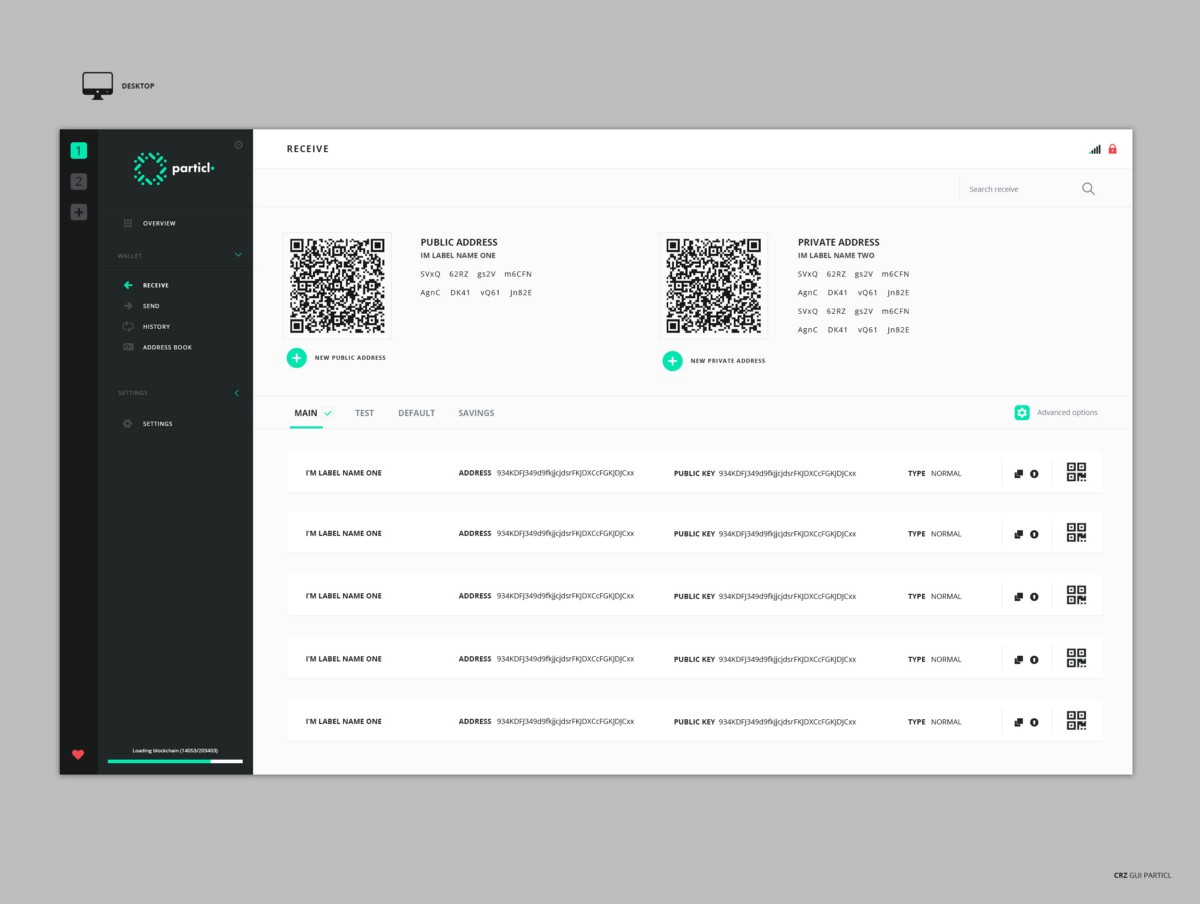

Industry-leading & User-friendly Graphical Wallet

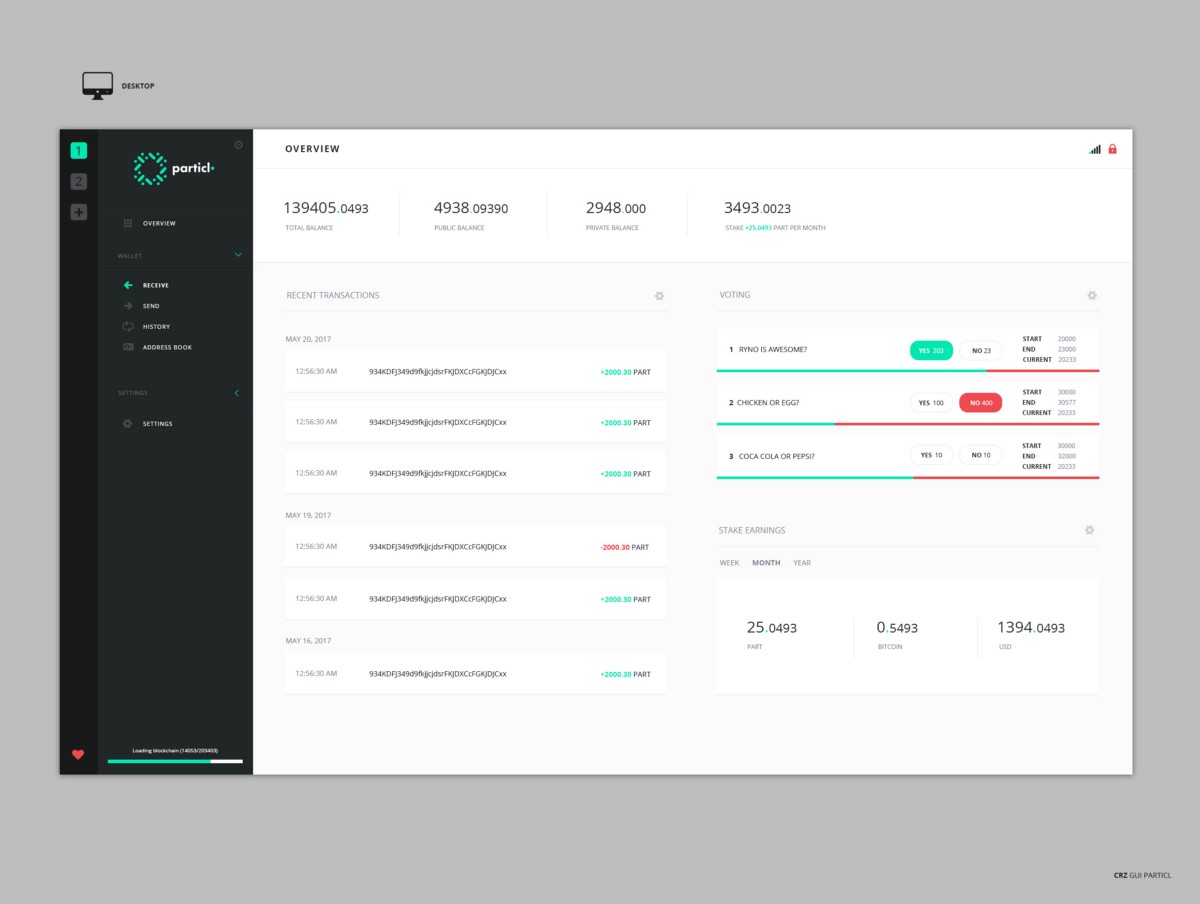

All the aforementioned Particl features wouldn’t be as exciting if they weren’t supported by a user-friendly and eye-appealing wallet. Not everyone wants to use terminal-based wallets and even fewer people know how to. Fortunately, the Particl team has some of the best graphical designer and UI/UX devs in the crypto scene, as evidenced by their previous work on Shadowcash’s Umbra wallet built using HTML5.

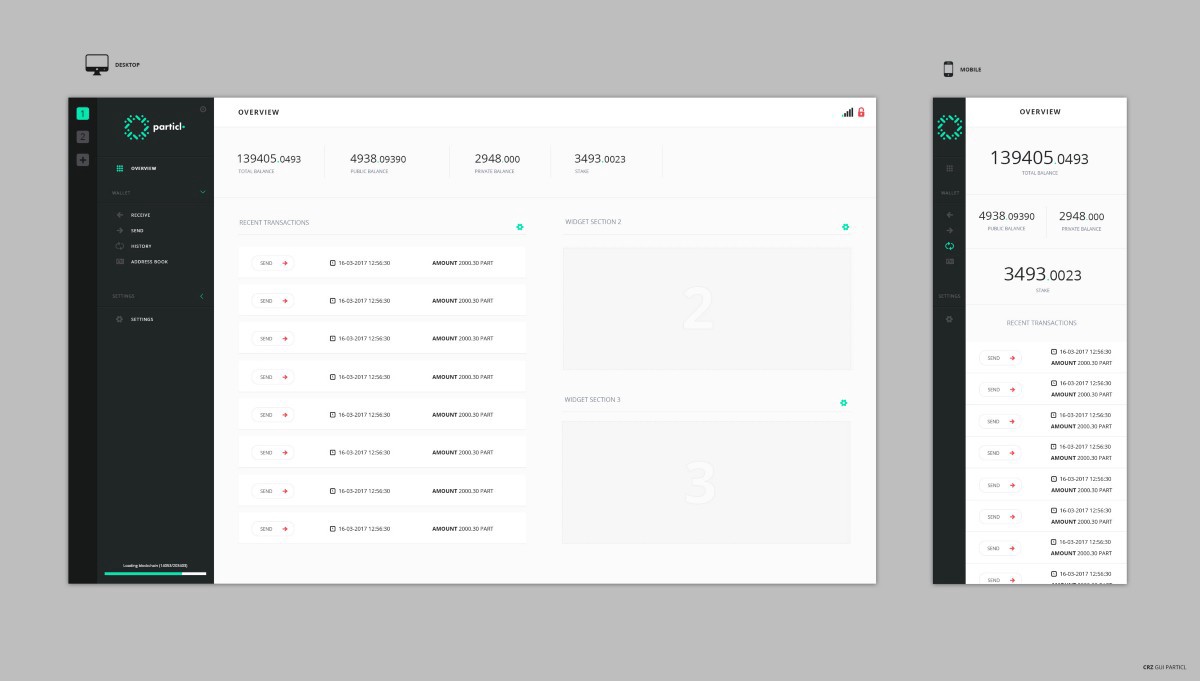

This time, the team has taken their GUI work to the next level! Started from scratch, the Particl wallet is built using the open-source project Electron (https://electron.atom.io/) and AngularJS (https://angular.io/) as its main framework. The Particl wallet does away with the QtWebKit engine on which is created all the crypto Qt wallets to make it more secure, beautiful and flexible. At this stage of adoption, it is very important for a blockchain project eyeing the mainstream to have its platform as easy to use as possible. Indeed, Particl’s end-game is to make almost everything related to crypto work seamlessly in the background while offering users a very intuitive experience not more complicated than using web-based marketplaces such as Amazon, eBay, etc. A web portal (a website where one could use the Particl marketplace without even downloading the wallet and blockchain) is even planned for later, though the team is currently focusing on first releasing the market.

Security-wise, Electron offers substantial improvements over QtWebKit because of how rendered processes are sandboxed leveraging Chromium’s rendering engine. “A sandbox, in computer security, is a security mechanism in which a separate, restricted environment is created and in which certain functions are prohibited” (https://www.techopedia.com/definition/27682/sandbox-computer-security). In Particl’s context, it means that if an attacker was to exploit a vulnerability within a Chromium rendered process, the damage would severely be limited to this very process and could not spread to other processes due to the engine’s sandbox.

On the aesthetics side, the interface is made much more appealing than the famous Qt engine. Written entirely in HTML, CSS, and Angular, it is much more interactive than any crypto wallet currently released and is designed with a “modular” approach to it. Indeed, the wallet supports the use of many widgets which can be selected by the user depending on what information they want to quickly be able to glance at. They display much useful information about the wallet in a neat visual fashion, and users can very easily customize how their wallet looks by adding/removing whatever widget they want. Elements they can display include (but are not limited to) staking data, voting data, transaction history, marketplace data, network data, etc. As they are basically only visual representation of blockchain/p2p data, it is very easy to add more of them. It will be interesting to see what the community comes up with in terms of useful widgets they can code and add to Particl. Also, as the project advances in time and new Particl Dapps are created, using widgets will lead to very different and personalized experiences from person to person depending on what is their main reason to use the Particl wallet (staking investment, shopping, holding, gambling on a Particl Dapp, etc.).

For more screenshots of the Particl wallet, you can either visit this link of GUI progress screenshots (http://imgur.com/a/AwNSX, posted on May 22nd, so may be outdated) or simply go ahead and participate in testnet #4 which is the first iteration of Particl testnet to include a GUI version.

Wallet Installer

Another useful feature the GUI wallet will have is an installer that automatically pops up the first time a user launches the wallet and offers to set up lots of stuff such as wallet file importation, privacy sliders (a user can choose how much privacy he needs to set up DSNs), tor installation, etc. Again, as the project grows, a lot can be added to the installer to make it even more useful and render the experience as user-friendly and customizable as possible.

Future Features

Even though Particl will already offer quite an impressive set of features on day 1, the team has lots of goodies planned for the future.

One of them is a mobile wallet with ALL desktop features enabled, including messaging and marketplace shopping. The only aspect the team is not sure about integrating into its mobile wallet is staking since it has a couple of drawbacks (potentially high number of unstable nodes due to bad phone reception, battery draining, possible security vulnerabilities, etc.).

Fiat gateways are also high on the list of priorities. While a solid crypto marketplace could find its niche within the crypto world, it would be much more difficult to go mainstream if it didn’t support integrated fiat deposits and withdrawals. In a way, this is already covered through the Shapeshift integration using Tether (USDt), but more options are always appreciated. The team is considering partnerships with fiat gateways like Changelly which allows the use of credit cards as a funding method or using exchange API keys to integrate fiat pairs into the wallet.

Another future feature of the project is to establish web portals on which people can access some (or all) functions included in the desktop wallet. The end-game here is to allow people to shop on the marketplace using a website and without having to download the wallet and the entire blockchain. This would make it much easier for regular, non-crypto people to use and is one of the things that could greatly help Particl have a shot at becoming mainstream.

The team is also looking to integrate more DSNs through partnerships (Siacoin, SafeNetwork, IPFS, etc.) and others method of network routing such as i2p. This is of course with the goal to provide users with a vast array of choices to suit their security needs and budget (as DSNs can vary in pricing fees).

Competition

With all that being said, it is now time to look at who are Particl’s competitors. After all, the crypto world is now an extremely competitive space and it could lead to several BETA vs VHS or Blu-ray vs HD DVD situations where many projects would compete in the same sector until one becomes big enough to stomp its competitors out of business. Hopefully for Particl, it has one huge advantage in the fact that it actually competes in several sectors, dramatically increasing its exposure and chances of success. Please note that the following paragraphs will contain a lot of subjective opinions on why I believe Particl is a serious competitor in many industries, so take it with a grain of salt and come up with your own conclusions.

As A Currency

Particl definitely meets the criteria to be considered a competitor in the payment currency sector of crypto. Not only does it possess all the same features as Bitcoin and other similar currencies, it literally hosts a decentralized marketplace on its wallet on which its native currency is used to trade goods and services. This is a use-case that very few currencies can claim to have, but it doesn’t stop there.

Particl also directly competes in the field of privacy coins where Monero, Zcash (and similar ZK SNARKS coins) and DASH are furiously battling. Just as in the payment currency sector, Particl doesn’t need to shy away here at all. It does possess a similar (and arguably better) implementation of Monero’s privacy tech, RingCT, and even adds Lightning Network + CT on top of it for a very impressive privacy combo (RingCT + CT + LN combo). This should be very interesting for a lot of people and projects that wanted to easily add a RingCT coin to their platform (i.e. Jaxx wallet).

As A Marketplace

Another obvious crypto sector in which Particl is a serious competitor is with decentralized marketplaces. This space has a limited number of competitors such as OpenBazaar, Syscoin and Bitify. Personally, as an investor, my subjective opinion is that decentralized marketplaces are going to become a big thing in the years to come. This is why I research these projects a lot, and my conclusion is that Particl has the most potential to be adopted as a market through its user-friendliness and the many features detailed throughout this presentation. Its two main competitors, OpenBazaar and Syscoin, do have some interesting features but I believe they will not outperform Particl in terms of both popularity and investment returns.

In the case of OpenBazaar, it is simply not possible to invest in it and while it charges no fee, its user experience is years away from any kind of mass adoption and has a p2p approach I am not too fond of. It also offers poor privacy and security parameters and should not be relied on by vendors looking for the ultimate privacy experience. What I find to be the most annoying thing about OB is that a vendor needs to host his shop on a computer/server and leave it open all the time. Failing that, the listing is put offline and the vendor cannot make any sale. It is possible to host your shop on a third-party server to make it more reliable in terms of uptime, but that is taking the control out of your hands and a security risk as well as going against the decentralization principle of the crypto world. OpenBazaar plans to launch a second version of their marketplace using IPFS which would allegedly eliminate the need to have a computer open at all time, but that does imply that they will need to introduce a fee structure to their platform.

With Syscoin, there are other problems that I see. The first one is that the user-experience is simply horrible and the wallet itself is not eye-appealing at all. Their solution for this was to create BlockMarket, a more user-friendly but closed-source interface interacting with the Syscoin blockchain. While it is definitely better looking than its Syscoin backend, it is still years away from any kind of mass adoption and its look would most likely turn off anyone that is not involved in crypto. What worries me the most about Blockmarket, however, is that it is basically a glorified centralized marketplace. In fact, The Blockchain Foundry (the company who developed BlockMarket) has total control over what content is hosted on its market. It can ban users and delete/censor listings at will, which leads me to wonder why one would even use the platform as it actually doesn’t provide much that centralized marketplaces such as Amazon and eBay don’t. It also doesn’t provide the set of privacy tools Particl offers, making it a no-go for any vendor looking for high levels of privacy. Also, purely from an investment, I believe Syscoin to not be as worth it as Particl because people can use other currencies on BlockMarket without having to touch Syscoin wat all. This is also the case with Particl, however, the latter automatically converts all other currencies into its native coin (PART) in order for a market order to be possible, so even though a user buys something with Bitcoin, it ends up being a Particl transaction, generating demand. It also should be noted that Particl is PoS while Syscoin is PoW, and I believe the proof-of-stake protocol is more fitted for a marketplace as it allows a lot of great features such as decentralized market governance and market fee earnings. Lastly, another problem I see with Syscoin is that should it become very popular, it would have some serious troubles with scalability as all market data are stored directly on-chain (contrary to Particl which stores data off-chain on DSNs).

Though it may seem that I am hating on the other projects, really I am not. I do believe this kind of industry can and will have enough place for more than one marketplace. After all, we have Etsy, eBay, Amazon, Craigslist and Alibaba all co-existing and sharing the same space, but with each one having its niche features and appeal to different audiences. There is nothing indicating that this could not be the case in the crypto world as well. Here, Particl definitely is the most secure and private solution, and this is what excites me the most as a privacy enthusiast.

We should also not forget about centralized, well-established marketplaces such as Amazon and eBay. These giants sure do have a huge share of the global market and have some really great features decentralized marketplace can probably not even dream of offering (at least for now), but they do have negatives that decentralized solutions can do better. Please refer to the previous “Target Users” section of this presentation, or read my previous article on this very subject by following this link: https://decentralize.today/who-is-going-to-use-particls-decentralized-anonymous-market-and-why-is-it-so-badly-needed-7eb79cc8b9ad

I believe that decentralized marketplaces can compete with centralized ones in these aspects:

- Controversial & potentially illegal goods & services

- Perceived gray area businesses

- Unfairly blocked businesses

- People looking for better protection of personal/corporate data & documents

- Taxation resistance & revolts

- People from the unbanked world where banks and e-commerce websites are not present

- Much lower fees than centralized counterparts

- Any crypto user looking to shop with his favorite coin

As A Dapp Platform