If you're interested in cryptocurrencies, then you've most definitely seen the terms "DeFi" and " Web3" thrown around. In fact, they are currently all the rage and are driving a ton of liquidity and capital into the blockchain industry.

But like many hype trains in the past, whether that be the dot-com bubble or the more crypto-centric ICO craze, does Web3 live up to the hype? Does it really do what is says it does? Is it doomed to fail or is it evolving in the right direction?

To answer these questions, it's important to go back to the roots, see how the internet has evolved over the past few decades, and put a clear definition on these terms.

Web1, 2, 3, Defi...What Does That All Mean Anyway?

When it started in the 90s, the internet was a simple framework on which people could build and publish simple web pages and basic applications. And while it turned society on its head, it was very basic compared to what it would evolve into. That rudimentary phase of the Internet is referred to as Web1.

Web2 is the evolution of that phase and it still powers most of today's internet. This phase is characterized by the advent of more complex applications and the rise of data mining. This is when major corporations understood the power and global reach of the web and decided to take it over, often with rent-seeking business models and with little to no regard for its users' privacy. Looking back on this phase, Web2 can best be showcased by companies such as Facebook, Twitter, Reddit, the more old-school MySpace social media and Deezer music streaming platform, as well as all the SaaS/subscription enterprises and data mining firms like Campbridge Analytica. Web2 offers much more than Web1 ever did, and a lot of the time for free, but it flipped things around by turning you into the product.

But many see the leeching business models and reckless data mining operations of corporations dominating today's internet as a major flaw, and one that is nearly impossible to protect oneself from as the web is growing more and more centralized every day.

And that's where Web3 comes into play. With the release of Bitcoin as the seed and the launch of Ethereum in 2015 as the catalyst, Web3 promises to fight off corporations and monopolistic organizations that dominate today's web and part ways with their predatory business models.

With the help of decentralized and peer-to-peer technology, entrepreneurs and developers all around the world are building a myriad of ‘dapps’ - distributed applications that don't require any central party to run - and its advocates promise us a free (as in freedom) and open internet that is fully decentralized and free of central intervention.

In other words, Web3 is about taking the power and control from the hands of corporations and putting it in the hands of the people.

As for DeFi, while it is often used interchangeably with Web3, it is actually a sub-category of Web3 characterized by dapps that offer financial services (similar to what one would expect from a bank, for example), but offered in a decentralized manner and without third-party involvement. DeFi can include anything from decentralized exchanges (dex) to sophisticated protocols that allow for staking, lending, borrowing, and more. We'll come back to it a bit later in this article.

Does Web3 Live Up to its Promises?

As with anything that seems "too good to be true", a fair dose of skepticism and proper research on any bold claim is always healthy. And indeed, Web3 promises the world. But what is it, precisely, that it promises?

Open and permissionless: Web3 is designed to be open to all, with no discrimination. It is also intended to be "permissionless", meaning that anyone can participate without requiring the approval of a central authority (i.e., throught the verification of an email, identity, or of certain documents like a passport or proof of residency). This promise is, after all, one of the greatest perks Bitcoin introduced to the world of finance in 2008.

Programmability: Defined by the ability for developers to build a near-infinite number of applications, use-cases, and autonomous services. This Web3 capability is notably important when we think of cryptocurrencies as programmable assets that can accomplish certain tasks based on certain conditions, but without the need for a central authority to validate or run any process.

Decentralization: The word decentralization refers to the distribution of ownership or control over a large network of participants. In the case of Web3, it means that dapps and cryptocurrencies are run, validated, and maintained by a vast network of peers – in contrast to corporations, like in the case of Meta or Reddit, for example. Decentralization enables resiliency against attacks, censorship, or issues like power cuts or technical/human mistakes. But equally or perhaps even more important, it also distributes the governance and decision-making process of dapps and networks to its actual participants.

Non-custodial: This crucial aspect of Web3 refers to owning your own assets or data. When you connect to a Web3 dapp or service, you are said to retain full control of your cryptocurrency keys and, some say, data as well. Compared to Web2 apps where third-parties will inevitably own custody of your funds when you deposit them on their platform (i.e., topping one's account), a non-custodial approach to digital ownership is a major improvement in security and lets you retain full control over your finances.

Immutability: This means that actions done in the past cannot be undone. If you transfer funds to another person using a cryptocurrency or through some Web3 dapp, it is promised that this cannot be undone and that the settlement is final. That specifically comes in handy within the world of eCommerce where online sellers are constantly met with chargeback risks, fraud, and identity scams, but it really is a strong benefit for anybody that "uses money".

And while there are many more benefits to using Web3, the ones mentioned above are largely considered as being the most relevant. But now comes the hard question: are these claimed benefits even real? Do they exist in the real world or do they solely reside in marketing pitches where one project tries to sell you a dream in order to raise capital funding?

Let's look at the facts.

Web3 and the Real World: The Cold Hard Truth

The promises of Web3 are huge, and if they are true, this new web framework will undoubtedly change the world. But the reality seems to point to a different picture - at least so far.

Web Dapps are Convenient, But at What Cost?

In recent years, we've seen the cryptocurrency industry move from a desktop client-based approach into a web-based one. Notably, with the advent of Ethereum, it is now standard for dapps to be deployed on the web rather than through a wallet or desktop client. And really, it makes a whole lot of sense, doesn't it? It makes the dapps much more accessible, and similar to traditional Web2 apps in terms of user experience. And in a world where ease-of-use and user-friendliness is paramount, making web-based dapps should be an ultimate end-vision for any Web3 project.

But like most "convenient" things in life, doing so currently comes at a hefty cost. Let's take the case of Ethereum, as it is the largest network powering Web3 apps. Do you know anything about the company Infura? No? Well, you should, because it powers much more of Web3 than they might like you to realize.

From their own website, Infura, which powers cornerstone Web3 services and dapps such as Metamask, Brave, Uniswap, OpenSea, and others, provides a "suite of high availability APIs and Developer Tools [to] provide quick, reliable access to the Ethereum and IPFS networks so you can focus on building and scaling next-generation software.". And as part of their services, they provide high-reliability nodes that developers can use to deploy and run dapps without having to run one on their end.

After all, an Ethereum node currently takes well over 1 TB to run and requires a constant connection to the network for a dapp to be reliable and permanently accessible to its users. And while that all sounds practical, we must really ask ourselves what are the costs or tradeoffs of such convenience.

While Infura offers its services for free under a certain number of daily requests and for a limited number of dapps, it falls back to the rent-seeking behavior Web3 seeks to move away from; running high-throughput nodes is very expensive. But that's far from being the worse aspect tradeoff of using a node service like Infura.

It also collects IP addresses and geolocations, making it possible for them to ban users based on totally arbitrary factors. We've covered this awkward state of affairs in one of our previous articles, but here's an article detailing the debacle in more detail.

There's no two-way about it, it is an issue that a company claiming to power Web3 would fall back to the same old crusty behaviors of Web2 companies (censorship, rent-seeking business models, data collection, unilateral control). But that ties into an even bigger issue here.

While Infura is a business which one could argue is free to operate as they wish, they do make up for at least 5 to 10% of all the nodes on the Ethereum network. Considering that these nodes tend to be more reliable and stable than user-run nodes, and also considering that they power of the most widespread back-end components of Web3, their grip and influence on the Ethereum is much, much greater than its official node count of 5% to 10% of the network.

Web3 is Powered by...Amazon? What!?

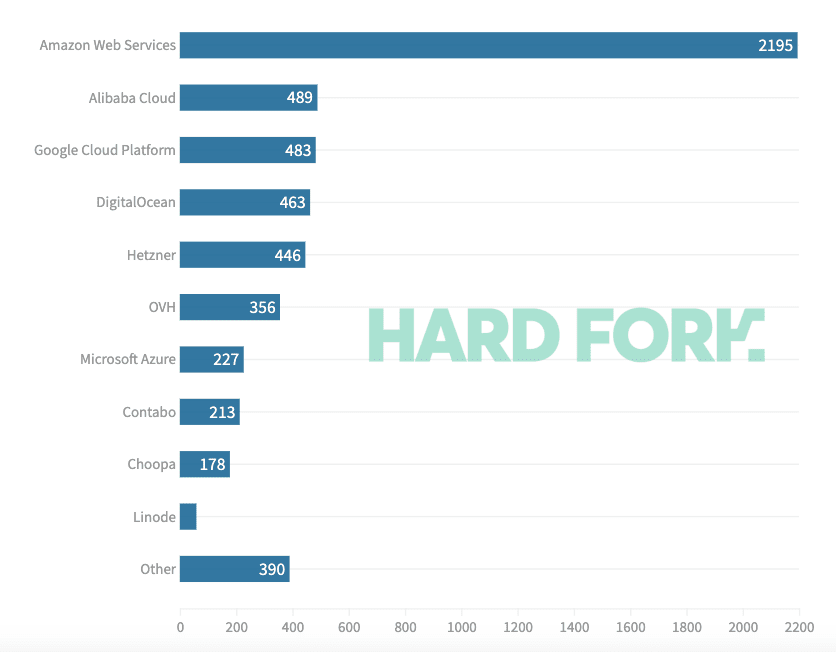

There is another awkward fact about "Web3": more than 60% of Ethereum nodes are hosted on cloud servers, with a worrying 25% of the entire network being hosted by Amazon, of all corporations! And as you can probably guess, the other usual suspects follow Amazon right in their footprints - with Alibaba, Google, and DigitalOcean also providing a substantial percentage of node distribution.

And this spells a whole lot of trouble because nodes are what keep the network alive. To fulfill Web3 and crypto's promises of decentralization, nodes should be mostly run by users or, at the very least, in a bigger proportion than the trends we are seeing today. Otherwise, it leaves the door open to a lot of potential problems. Yet, less than 40% of nodes are run independently by users.

One prime example that illustrates the dangers of being at the mercy of cloud server services is the troubling story of the Parler app in 2021. Parler was a Twitter-like social media, used mostly by right-leaning politically enthusiast individuals catching bans from Web2 behemoths like Twitter, Facebook, or Reddit. At a time when the platform was seeing an explosive surge in popularity — even hitting top rankings on both Apple Store and Play Store — Amazon, Google, and Apple all simultaneously decided to shut down all services provided to the application within 24 hours of each other.

While being kicked off both Apple's and Google's app stores is a hard blow to recover from, being kicked off Amazon proved to be a killer shot for Parler. Indeed, the aspiring social media developers had made a critical mistake when coding their controversial application; their data servers were all hosted on Amazon with no backup elsewhere. And when Amazon decided to kick them off, they didn't give them the time or opportunity to transfer the platform's data out, effectively killing off the app by losing all of its data, user information, and login credentials.

That shouldn't come as a surprise to anyone, though. Sure, a political argument for censorship can be debated regarding the controversial content that was allowed on Parler during a time of high political turmoil, but let's not forget that Amazon is no stranger to shady and unilateral deplatforming policies, as several companies have warned for decades.

And with 60% of Ethereum nodes hosted on cloud servers and 25% on Amazon alone, are we really just forced to live on the hopes that Web3 never becomes controversial enough for our corporate overlords to decide to "pull the plug"? And what if a country decides to ban Web3, citing absurd political excuses that most certainly will refer to "keeping us and our children safe from harm", and forces Amazon, Google, and DigitalOcean to comply "or else"? After all, the United States of America account for about 34% of the total Ethereum node count...

MetaMask and OpenSea Expose Web3 as Incredibly Centralized

Pulling the plug on Web3 and its users is definitely a very real possibility in a world that grows more tyrannical and hungry for control by the day. Targeted attacks on freedom within the blockchain and Web3 industries can — and already have — occurred as well. That much has been fully exposed by the collusion of MetaMask, OpenSea, and certain governments through arbitrary sanctions targeting people solely based on their nationality.

Not only @opensea

— Bornosor (@Bornosor) March 3, 2022

But MetaMask itself is also BANNING every wallet associated with an Iranian IP address.

🚨 THIS IS NOT A DRILL 🚨

Iranian People are losing access to their NON CUSTODIAL Wallets with this update.

This is UNACCEPTABLE! pic.twitter.com/qDEBcezJba

MetaMask, a web and developer-friendly wallet that is certainly convenient, is a huge contingency for Web3's decentralization. While it claims to be devoted to keeping its services decentralized, they still rely on the infamous Infura services to operate. And the issue is Metamask powers a whopping number of Web3 dapps and is even the defacto wallet for many Ethereum forks and networks alike.

Let's take the crazy and trendy world of NFTs as an example. NFTs, short for non-fungible tokens, are all the craze right now and promise to usher in a new form of digital ownership. While it currently focuses on funny images and digital art collectibles, its promises are big: land titles, legal documents, ownership certificates, and more.

OpenSea, a decentralized marketplace focusing exclusively on the buying and selling of NFTs, currently owns 95% of the NFT market share. And as you may have guessed, it is powered by none other than Metamask — which is in turn powered by...Infura! Now do you see why the seemingly "not-too-bad" node count of 5% to 10% share of the Ethereum network Infura has can quickly turn into a nightmare? And turned into a nightmare it absolutely did...

Back in March, a scandal emerged after Metamask and OpenSea blacklisted Iranians, Venezuelans, and Russians from using their services, locking them out of their wallets and leaving them to struggle heavily to recover their funds. Yes, one can still export their seed to recover their coins or NFTs, but with OpenSea owning 95% of the NFT market share, where does that leave artists? And most importantly, what does that tell us about the promises of Web3 when one of its biggest dapp proves to be nothing more than a glorified Web2 monopoly?

We’re truly sorry to the artists & creators that are impacted, but OpenSea is subject to strict policies around sanctions law. We're a US-based company and comply with US sanctions law, meaning we're required to block people in places on the US sanctions lists from using OpenSea

— OpenSea (@opensea) March 3, 2022

After all, it's not just the node count that counts, but how much of Web3 each individual node powers.

The Elephant in the Room

An elephant in the room is, by definition, something quite obvious and problematic that nobody wants to talk about because it is inconvenient or uncomfortable to even discuss. And Web3's current elephant in the room is its inexcusable, complete, and total lack of financial privacy.

As we've seen at the beginning of this article, Web3 centers around programmable money with DeFi being a very important category of Web3. DeFi offers an array of financial services that range from trading assets or getting collateralized loans, to lending out assets, and much more. And the ability to do all that without banks or central parties is surely appealing but there is a very sad reality: all DeFi transactions are inherently public by default, and without financial privacy, it will not be equipped to face the problems of tomorrow.

Let's not sugarcoat it: DeFi cannot be seriously adopted by institutions, financial organisations, or even retail investors because all transactions, balances, and history of anyone participating in it are public. If someone knows your cryptocurrency address, they can see all the payments you've made in the past and to whom you've made them. They can track, forever, any incoming payments you make and see how much you're lending to others, through what platforms, with which interest rates, and they can even track how much you're borrowing. They can see how much you make staking various assets, what you trade, and also at which price you trade which asset. Does that really sound like an improvement over traditional banking?

Sure, you can do all of that without going through long and tenuous user verification processes. You can do all of the above often with no to little fees, and you can program all of that using smart-contracts and scripts. But really, you're also exposing your entire financial life to anyone curious enough to find out!

Imagine, just for a moment, a simple scenario where Web3 is now used for the payment and digital transfer of legal documents involved with a home purchase. You buy a house with a cryptocurrency transaction and perhaps receive legal documents as a form of NFT on your (probably by then) government-verified Ethereum address. Sounds exciting and futuristic! But now, the seller of the house can see all your financial history and information, down to the cent. Or perhaps it is you that tracked all of the seller's finances down when he first sent you his crypto address. Sounds futuristic, yes, but also very dystopian - and the truth is that nobody, especially businesses and institutions, will take DeFi and Web3 seriously until it comes pre-packaged with financial privacy.

The Immutability Requirement

An important and core aspect of Web3 is its immutability, or the inability to reverse a transaction or transfer of data after the fact. And here, too, there are glaring issues that should insult any blockchain proponent.

While ETH and other cryptocurrencies like SOL or BNB are very popular within the DeFi world, stablecoins like USDC, USDT, or LUNA have gained tremendous traction in the past year. In fact, Bitcoin's dominance over stablecoins has gone down from 91.57% to 75.67% in the past year, a whopping 15.9% drop. And it is easy to understand why; stablecoins provide the benefits of Bitcoin and other cryptocurrencies, but do so with a stable price pegged to national currencies like the US dollar.

But here lies the issue: asset-backed stablecoins like USDT and USDC are essentially centralized IOUs, with the companies that run these coins having full control over them. And yes, Tether and Circle can indeed freeze, reverse, seize, and blacklist coins and addresses as they see fit.

"Today, Tether has frozen three addresses on the Ethereum blockchain containing $160m USDt upon a request from law enforcement. At the moment we are unable to disclose any further details"

So scratch what we've said above, not all stablecoins provide the same benefits as regular cryptocurrencies like Bitcoin. And with stablecoins being on the rise within Web3, which stablecoin becomes dominant is an incredibly important issue.

As always, we can suppose good intentions regarding why certain assets would be freezed — perhaps these were hacked or stolen coins, for example — but what if you unwillingly get on the wrong list? What if you happen to be born in the wrong country and some government put sanctions on your country of origin and then pressures Tether to seize your funds? After all, it already happened to Iranians, Venezuelans, and Russians. Who's next? This mere possibility goes against the promises of DeFi and crypto in general and this slippery slope should be vehemently rejected by all.

The fact is, cryptocurrencies are mostly immutable — that much is true and not an empty promise — but it's worrying that some of the most popular stablecoins being used in Web3 today can be seized or blacklisted by central authorities. Always make sure to research what coin you use when using a Web3 application. Not all coins are created equal in terms of freedom and asset ownership!

So… Does Web3 Live Up to its Promises?

While the ultimate vision and dream of Web3 is something to aspire to, the short answer is no, not at this time. Web3 does not live up to its promises, at least not today — but those promises are definitely within reach and can be reached...given that the Web3 community is willing to move in the right direction.

Let's take a look at the aspects of Web3 we've reviewed at the beginning of this article and compare them to today's reality.

Decentralization: Web3 is awfully centralized and, under all its glitters, the reality is that node distribution is awful as well. Big tech positioned itself to control the vast majority of Web3 nodes, and crypto-based companies like Infura, Metamask, and OpenSea (to name only a few) are slowly building their way up to become central overlords — just like their centralized counterparts like Meta, Paypal, or Twitter — with unilateral power and control.

Open and permissionless: While this seems mostly true on the surface, this is simply not the case with the current state of Web3's centralization. If you're established in an "undesirable country", or find yourself to be an "undesirable person" based on arbitrary criteria from centralized parties or powerful governments, you better use a VPN or proxy and have excellent online hygiene, or else you'll feel just as if you were using any other Web2 application as the banhammer comes wacking at your head.

Non-custodial: This is, for the most part, a promise that is being held at the protocol level. It, however, comes with a caveat, the vast majority of Web3 applications use centralized node services that can make your life hell. Even if you can recover funds after being blocked by some Web3 service provider, the inability to use said Web3 dapp (or really, in that case, they are more like glorified "apps" without the "d") really goes against the very ethos and end-vision of Web3's promised openness. Again, good luck enjoying Web3 as an Iranian NFT artist...

Immutability: This is mostly true if you use the right cryptocurrencies. As we've seen, there are obvious cryptocurrencies to avoid such as USDT and USDC as the companies that run them can decide, on their own or under pressure, to seize, reverse, blacklist, or freeze your funds. But, assuming you're avoiding those, immutability is generally a promise that's successfully achieved by Web3.

Programmability: Even though the reality seems a bit darker than the dream pitched by early Web3 aficionados, one thing that holds very true about Web3, even today, is that its programmability is second to none. That much is easily observable with the myriad of creative and outside-the-box dapps hitting the market every day and with the insanely fast-growing web3 developer community. In fact, did you know that, according to a report by Electric Capital, more than 34,000 new developers pushed Web3 code in 2021? Did you know that the monthly rate of Web3 developers pushing code on Github is 18,000+? Did you know this figure grew a whopping 20% in the past year?

There is no doubt: the market and society as whole want to see Web3 and all of its promises succeed and come to life as envisioned. To see the space pioneer towards Web3 is certainly encouraging, but nobody wants to see it fall back to the same old Web2 rut and be wasted. Web3's benefits are huge, but we are not there yet in term of its evolution.

And perhaps more importantly, as we stand at the crossroad of its adoption and growth, a change in mindset has to happen to the Web3 community else it risks becoming gridlocked in its current ways after which it'll prove very difficult to change course.

But Not Everything is Grim!

It is with this strong desire to cut off the middleman from most areas of our lives and improve Web3's situation that we, at Particl, have built and keep on building a uniquely decentralized and private ecosystem of dapps that fix the outstanding obstacles Web3 currently faces.

It consists of a private cryptocurrency (PART), an online distributed marketplace, and a (soon to be released) DEX. Because our dapps are powered by a P2P messaging network that doesn't rely on any central server or node provider service, you can enjoy the benefits of Web3 without its dangers and downfalls.

And while it is still in its infant proof-of-concept stage, Particl dapps are currently accessible, today, through our desktop client. No Infura, no reversed transactions, no censorship, no financial doxing, and no geo-blocking. Just pure and private Web3 goodness.

Admittedly, Particl dapps might not be as convenient as other Web3 dapps available from your browser, but we're working towards making that possible in such a way that doesn't compromise on your security, privacy, and freedom to interact with Web3.

But doing just that in a proper way and without falling back to a Web2 framework ain't easy and it takes time. And that certainly explains why Web3 still isn't delivering on many of its promises, even after so many years and with so many developers working on it.

But as you know, all great things take time and we're absolutely convinced that Web3 will end up shining strong. In truth, it is already a beacon of hope for those aware of just how bad Web2.

Want to See Web3 Succeed?

Want to see Web3 succeed? Want to help prevent it falling back to Web2's old rut? The best you can do is be upfront and honest about its current issues and educate others around you about it.

A change in mindset is required to avoid the trap of falling back to the same Web2 model, but as you know, change never come by itself.

If you know anyone involved with Web3, be it a developer, project manager, speculator, NFT artist, influencer, or anyone else, really, share this article with them and let them know what's currently wrong with it. The more people know about its problems, the more likely we are to see solutions appear!

And if you want to learn more about what we do at Particl and contribute to its growth, come join our awesome global community of cypherpunks and come have a chat about the future of the web with us on Discord, Telegram, or Element, or just give one of our dapps a try here.

Join the discussion

What's your stance? Curious to see what others already said? Even better, start talking about this story with peers and pals by tagging them in your tweets.

Is Particl Marketplace for you?

Buy and sell anything free of commissions, restrictions, and prying eyes.